Switzerland

Your Gateway to Global Crypto Legitimacy

Switzerland stands at the forefront of financial innovation, overseeing FinTechs, banks, securities companies, DLT trading facilities, and fund managers directly under FINMA’s supervision. For other financial intermediaries not requiring a full FINMA licence, Switzerland mandates membership in a Self-Regulatory Organization (SRO)—such as VQF or SO-FIT—both authorized and supervised by FINMA.

How We Help You Achieve SRO Membership Success

- Your External Compliance Team: We’ll manage the complexities of Swiss regulations, ensuring your policies and procedures align with FINMA and SRO requirements. Our expertise maximises your approval chances.

- Strategic Guidance: From advising on entity choice (GmbH or AG) to recommending the right SRO (e.g., VQF or SO-FIT), we develop a tailored plan fitting your crypto or FinTech activities.

- Comprehensive Support: Our one-stop service covers company formation, legal consultation, document review, AML/KYC policy development, and external audit coordination—streamlining the entire process.

- Corporate Account: Secure crypto-friendly banking and payment infrastructure with our expert guidance. We’ll introduce you to partner banks, EMIs, and card-issuing solutions.

- Post-Approval Compliance: We don’t just walk away after membership approval. Expect ongoing support for audits, reporting, and staying in step with regulatory updates—ensuring seamless operations.

Ready to launch your Swiss SRO? Let’s partner up! Contact us today.

Switzerland Regulatory System

Geneva is one of the top ten global financial centres, renowned for its stability and robust oversight by the Swiss Financial Market Supervisory Authority (FINMA). FINMA’s chief responsibilities include maintaining financial system stability and ensuring compliance among financial service providers. It authorises and supervises entities such as banks, insurance companies, stock exchanges, and other key market participants—covering FinTechs, banks, securities companies, DLT trading facilities, and fund managers under its direct purview. Other financial intermediaries that do not require direct FINMA supervision must nevertheless join a Self-Regulatory Organization (SRO)—for example, VQF or SO-FIT—each authorized and supervised by FINMA.

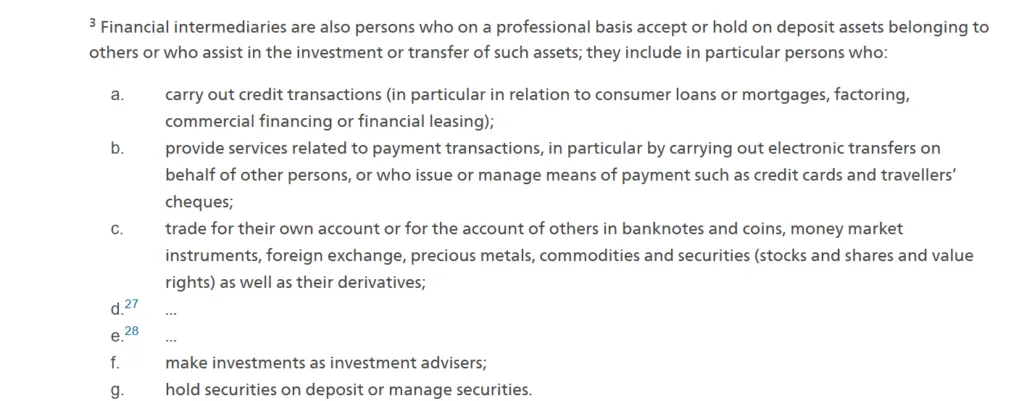

Under Article 2 of the Swiss Anti-Money Laundering Act (AMLA) (see Figure 1), any person who professionally accepts, holds, invests, or transfers assets belonging to others is considered a financial intermediary.

Figure 1: Article 2 of the Swiss Anti-Money Laundering Act (AMLA)

Article 1496 of the Swiss legal framework makes SRO affiliation mandatory for these intermediaries, ensuring they meet Swiss AML (Anti-Money Laundering) standards.

Why Switzerland? Key Benefits of SRO Membership

1. Clear Legal System:

Benefit from Switzerland’s rigorous yet business-friendly legal environment, offering transparent guidelines and robust investor confidence.

2. Established Financial Infrastructure:

Operate within a stable, globally recognized financial hub. Access reliable banking, payment gateways, and other essential financial services.

3. Outstanding Corporate Image:

Enhance your company’s reputation by aligning with Swiss regulatory standards—a hallmark of credibility among global clients and investors.

4. Flexible Tax System:

Enjoy Switzerland’s favorable tax regime and potential incentives offered by cantonal authorities, ensuring cost-effective operations.

5. High-Quality Blockchain Community:

Tap into Switzerland’s vibrant crypto and blockchain ecosystem. Join a network of leading innovators and experts driving the industry forward.

6. Government Support

Switzerland is known for forward-thinking legislation and support for emerging financial services, positioning your business at the cutting edge of technology and regulation.

What Can I Do with an SRO Membership?

As a member of a Swiss SRO, you’ll operate under Swiss anti-money laundering (AML) standards without requiring direct FINMA supervision—ideal for diverse FinTech and crypto activities. Your permitted scope may include:

1. Providing Payment Services in Fiat & Crypto

- Payment facilitation and processing

- Transfer of funds and crypto assets*

- Acceptance or assistance in transferring third-party assets

- Electronic transfers

2. Custody of Crypto

- Segregated wallet (unlimited amount)

- Omnibus wallet (limited to CHF 1m in total)**

3. Offering Crypto Services

- Perform an ICO, STO, or ISPO

- Issue a 1:1 fiat-backed stablecoin (plus bank guarantee)

4. Card Issuance

- Manage or issue payment instruments

- Act as a payment service provider

- Credit & debit cards

5. Accepting Deposits from the Public

- Limited to CHF 1m**

- Unlimited if received from institutional investors with professional treasury management

- Other exceptions may apply

6. Operating a Fiat/Crypto Exchange (CEX / FX)

- Fiat & crypto* on/off ramp

- Swap fiat ⇄ fiat

- Swap fiat ⇄ crypto*

- Swap crypto ⇄ crypto*

7. Brokerage / Trading

- Trade in crypto*

- Trade in currencies, precious metals, commodities (additional authorization may be required)

8. Crypto Asset Management

- Manage crypto* assets

- Operate as a crypto* market maker

9. Credit & Loan Operations

- Mortgages

- Leasing

- Commercial loans

- Consumer credit (additional authorization may be required)

*Note: “Crypto” typically encompasses digital tokens or coins. SROs may impose specific requirements depending on the types of tokens involved.

***Note: The CHF 1m limit may be increased upon further arrangements or specific SRO conditions.

Can Swiss SRO Members Operate in the EU? Navigating Reverse Solicitation

When Swiss-based financial intermediaries (including those with SRO membership) seek to serve clients in the European Union without an EU licence, the concept of ‘reverse solicitation’ becomes pivotal. Reverse solicitation allows a non-EU firm to provide regulated services to an EU client only if the client solicits those services on their own exclusive initiative. While this principle is expressly reflected in Article 61 of MiCAR and Article 42 of MiFID II, it is fact-intensive and evaluated on a case-by-case basis, making it difficult to offer blanket guidance.

ESMA’s Guidelines on Reverse Solicitation

The European Securities and Markets Authority (ESMA) has published detailed guidelines clarifying how reverse solicitation applies under the upcoming Markets in Crypto-Assets Regulation (MiCAR). Although aimed at crypto-asset activities, these guidelines shed light on ESMA’s broader approach to reverse solicitation—including promotional activities, the use of non-EU platforms, and the role of third parties (such as influencers or sponsors).

Key takeaways include:

- Technology-neutral solicitation: Any method—face-to-face meetings, digital ads, social media campaigns—can trigger “solicitation.”

- Wide view of marketing: Regional SEO, geo-targeted ads, EU-centric domains, and event sponsorships are likely to be construed as active solicitation, meaning a non-EU firm could no longer rely on reverse solicitation.

- Educational materials & events: ESMA acknowledges the importance of neutral, non-promotional content. However, genuine educational activities must not be disguised marketing.

- Execution venues & third parties: Non-EU platforms or affiliates advertising services on behalf of a non-EU provider may undermine reliance on reverse solicitation.

- Marketing new products or services: Reverse solicitation extends only to crypto-assets or services of the same type that the client originally requested. Marketing new or different offerings typically requires a separate initiative from the client.

In sum, SRO-regulated entities in Switzerland can provide crypto-related services to EU clients under reverse solicitation, but they must exercise extreme care to avoid any indication of active marketing within the EU. Failure to comply could result in significant penalties—underscoring the importance of understanding and adhering to ESMA’s guidelines for reverse solicitation.

Key Requirements for Swiss SRO Membership

1. Company Members (Fit & Proper)

- Valid passport & proof of address for all individuals

- Explanation of the source of funds

2. Documentation

- Business plan

- AML/KYC policy

- Articles of Association (AOA)

- Shareholding structure

- Information on branches and affiliated companies

3. Local Presence

- Appoint a Swiss-based compliance officer and director/signatory

- Maintain a physical Swiss office address

4. Minimum Capital

- CHF 20,000 (GmbH / Sàrl)

- CHF 100,000 (AG / SA)

Choosing Your Swiss Entity Type

Depending on your ambitions, corporate structure, and capital requirements, you may select from two common Swiss company types:

1. Limited Liability Company (Sàrl / GmbH)

- Minimum Capital: CHF 20,000

- Shareholders: At least 1, maximum 100

- Shareholder Anonymity: Names are public

- Share Transfer: Requires approval of the general meeting of shareholders

- Suitable For: Small/medium enterprises, family businesses

- Listing: Cannot be listed on a stock exchange

2. Stock Corporation (SA / AG)

- Minimum Capital: CHF 100,000

- Shareholders: At least 1 for unlisted, at least 7 for listed companies

- Shareholder Anonymity: Shareholders can remain anonymous

- Share Transfer: Relatively simple

- Suitable For: Larger companies, especially those planning global expansion

- Listing: Eligible for listing on a stock exchange

SRO Application Journey

Before Application

1. Documentation Collection & Preparation:

Gather and review all necessary paperwork. Develop and refine your business plan to align with Swiss AML/CFT requirements.

2. Entity Setup & Structure:

Provide strategic guidance on choosing the appropriate company type (e.g., GmbH or AG). Secure a legal address for your company, and assist with capital deposit.

3. Team Forming & Banking Solutions:

Recruit and onboard your local AML officer and director/signatory. Open an operational bank account in a crypto-friendly financial institution.

SRO Application & Authorization

1. Compliance Training & Documentation:

Train your local AML officer and director on Swiss regulations. Organize and compile all relevant SRO application materials.

2. Regulatory Engagement & Q&A:

Prepare detailed responses for SRO or FINMA inquiries, providing any additional documents or clarifications as needed.

After Obtaining Approval

1. Handover & Final Documentation:

Supply all confirmation letters, membership certificates, and official affiliation numbers related to your newly acquired SRO status. Provide a full document handover.

2. Ongoing Compliance & Policy Updates: Remain at your side to monitor regulatory changes, update your AML/CFT/KYC policies, and handle routine audits or reporting.

3. Continued Banking & Payment Solutions: Facilitate introductions to additional payment channels and solutions, including EMIs and card issuers, to support your business expansion.

The whole process will take 5-6 months.

Other Recommended Licences

Switzerland

Renowned for its strong reputation and offering the most comprehensive functionality for crypto services.

Canada

A cost-effective license to conduct both payment and crypto activities, making it attractive for new market entrants.

El Salvador

A pioneering country in the adoption of Bitcoin as legal tender, fostering crypto-friendly opportunities.

Slovenia

A stable jurisdiction with a longer transitional regulatory period (from VASP to CASP) until July 2026.

FAQs: Your Swiss SRO Membership Questions Answered

Switzerland offers a combination of strict yet business-friendly regulations, a stable financial infrastructure, and a global reputation for integrity. This environment not only grants you credibility but also provides access to crypto-friendly banks, cutting-edge blockchain communities, and governmental support for innovation.

SROs are private regulatory bodies authorized and supervised by FINMA to oversee compliance with Swiss AML (Anti-Money Laundering) requirements. By joining an SRO like VQF or SO-FIT, you’re subject to rigorous standards akin to direct FINMA supervision, but without needing a full Swiss banking or FinTech licence.

Not all. Large entities such as banks, securities dealers, and DLT trading facilities require direct FINMA supervision. However, smaller financial intermediaries (including certain crypto platforms, payment services, and custody providers) must affiliate with an SRO instead. Article 1496 of Swiss law makes SRO membership mandatory for these intermediaries.

No. An SRO membership demonstrates compliance with Swiss AML/CFT rules but does not give you the full range of privileges or regulatory burdens of a banking licence. It’s a streamlined path to legal operation for businesses that do not require direct FINMA oversight

You can handle a wide array of financial services, including but not limited to:

- Providing payment services in fiat and crypto

- Custody of crypto assets

- Operating a fiat/crypto exchange (CEX / FX)

- Brokerage and trading in crypto or certain traditional assets

- Offering lending, leasing, or mortgage services (with additional approvals if needed)

- Issuing stablecoins or other token offerings

On average, it can take 4–5 months to secure your SRO membership. This timeline includes company formation, document preparation, regulatory reviews, and establishing local presence and banking relationships.

Yes. SROs require a Swiss-based director/signatory and a compliance officer. You must also maintain a local Swiss office address. This ensures proper oversight and alignment with Swiss standards.

GmbH / Sàrl: CHF 20,000

AG / SA: CHF 100,000

Not automatically. The EU generally requires its own licences for offering regulated services. However, certain non-EU firms can serve EU clients under the principle of reverse solicitation—where the EU client initiates the relationship of their own accord. This is strictly fact-dependent, and breaching these rules can lead to severe penalties.

Reverse solicitation means an EU client proactively requests services from a non-EU firm on their own exclusive initiative. Under EU regulations (e.g., MiFID II, MiCAR), if your firm actively markets to EU clients, you generally cannot rely on reverse solicitation. ESMA’s guidelines provide clarity on what constitutes solicitation, emphasizing factors like targeted advertising, sponsorship, and influencer marketing.

In many cases, English-language documentation is acceptable to SROs. However, certain official documents or communications with local authorities may require translation. Our team can help coordinate any required translation services.

Typical obligations include:

- Regular AML/KYC reviews

- Maintaining robust reporting and record-keeping

- Annual audits (either internal or external)

- Staying updated on evolving SRO policies and Swiss legislation

Swiss banks are increasingly open to crypto ventures but still conduct rigorous due diligence. We assist in identifying suitable crypto-friendly banks or EMIs, guiding you through their onboarding requirements and ensuring your AML/CFT framework meets their standards.

Yes—subject to certain conditions and alignment with SRO guidelines and Swiss AML laws. You may also need specific legal opinions or additional documentation depending on the nature of the token or offering.

GmbH / Sàrl: Lower capital requirement (CHF 20,000); shareholders’ names are public; typically preferred by SMEs.

Switzerland generally allows tokenized securities if they comply with Swiss corporate and financial market laws. However, whether you need an SRO membership or direct FINMA licence may hinge on your business model. We help clarify these nuances on a case-by-case basis.

The compliance officer and director must be based in Switzerland to maintain a real local presence and ensure immediate regulatory communication. We can assist in recruiting suitable local professionals to fulfill these roles.

What Clients Say About Our Services

About CryptoLicence

CryptoLicence specializes in simplifying the registration and licensing process for crypto businesses in Switzerland and other global markets. We are dedicated to helping crypto businesses, startups, and investors navigate Switzerland’s regulatory landscape with ease, ensuring full compliance and smooth market entry.

With in-depth knowledge of key markets, we provide tailored compliance solutions for businesses in regions such as Hong Kong, Singapore, Malaysia, Europe and North America. Our expertise spans popular licenses, including the Czech Republic VASP license, Swiss SRO, Polish VASP, and Salvadoran cryptocurrency licenses. Our global network and understanding of local practices give your business a competitive edge.

We recognize the unique challenges international startups face, from navigating regulations and cross-border compliance to overcoming cultural and language barriers. CryptoLicence is here to offer end-to-end support, from interpreting the latest regulations to providing comprehensive compliance solutions. Our goal is to make the licensing process seamless, empowering you to expand your crypto or FinTech venture in Switzerland and beyond.

Your Swiss Crypto License Experts

Compliance Made Easy in Switzerland

Sheldon | Director

Sheldon is a seasoned FinTech professional with 7 years of experience specializing in cross-border payments and cryptocurrency licensing, spanning from the web2 to web3 era. He has successfully managed over 30 projects, delivering expertise in payment and cryptocurrency license applications. With a strong network of strategic partnerships, Sheldon brings valuable connections and resources to every endeavor.

Connect with Sheldon on LinkedIn

Jing C | Consultant

Jing is a skilled professional specializing in project management for regulatory compliance and financial institution business development. Currently handling licensing requests in Czech and Switzerland, he also brings a strong legal background in dispute resolution to his work.

Connect with Jing on LinkedIn

Boo | Consultant

Boo offers expertise in handling UK API and Hong Kong MSO license applications, as well as maintaining the Poland VASP license. With his previous experience as an analyst at a family office VC fund, he brings a valuable skill set to the firm.

Connect with Boo on LinkedIn

Cing | Consultant

Cing Hui is a corporate and commercial law specialist with expertise in overseas company formation, customized business solutions, and legal counsel. She currently specializes in MSB (Money Service Businesses) license applications for Canadian and American entities.

Connect with Cing on LinkedIn

Ready to Build Your Swiss FinTech or Crypto Future?

Switzerland offers a clear path to legitimacy through an SRO membership—without the complexity of a full FINMA licence. Whether you aim to operate a crypto exchange, offer payment services, or manage digital assets, we’ll guide you from inception to approval and beyond.

Let’s Talk!

Contact us today to explore your options and embark on a streamlined journey toward Swiss SRO membership. We look forward to partnering in your global expansion.

Have Questions?