Why Is Switzerland the Industry’s Top Choice? 3 Key Advantages That Attract Crypto Players

Amid the global crypto boom, Switzerland has emerged as a premier destination for Virtual Asset Service Providers (VASPs), thanks to its unmatched regulatory strengths. Its robust legal framework, low entry barriers, and efficient compliance mechanisms have made Swiss licenses particularly attractive. Here are three key advantages that reveal why Switzerland is the ideal launchpad for your crypto future:

Table of Contents

Advantage 1: Strict Regulation Builds Credibility

As a global financial benchmark, Switzerland has gained international trust through a transparent and stable regulatory system. For VASPs, holding a Swiss license not only quickly establishes industry credibility but also lays a strong foundation for global expansion.

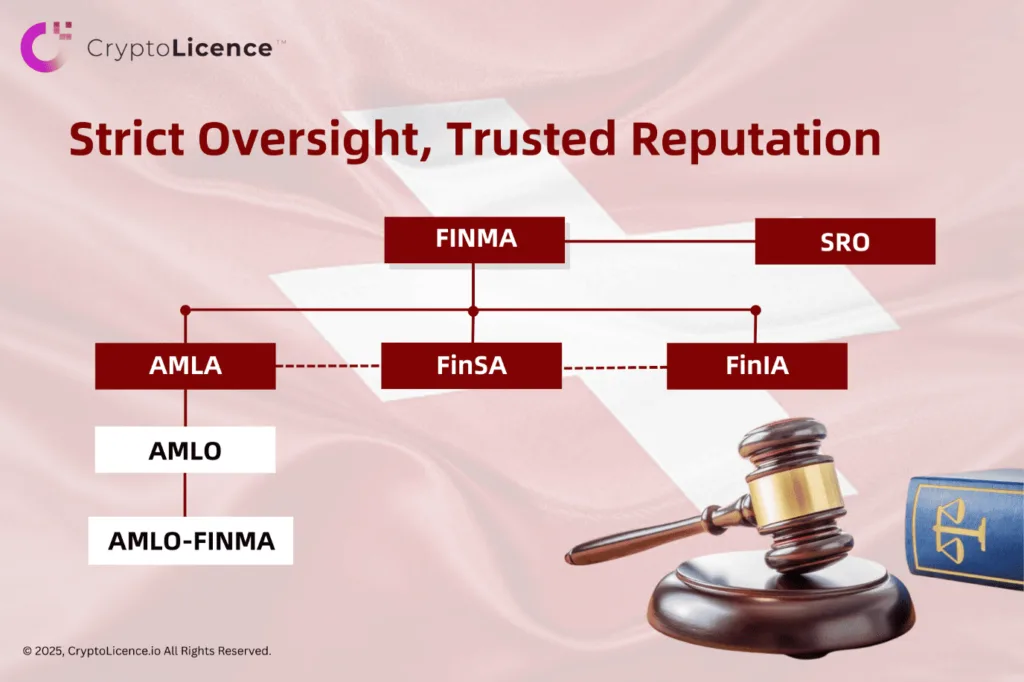

At the heart of this advantage is Switzerland’s comprehensive and multi-layered regulatory framework, built upon the Swiss Financial Market Supervisory Authority (FINMA) and the Federal Act on Combating Money Laundering and Terrorist Financing (AMLA). The high regulatory bar lends Swiss licenses exceptional credibility, making them a “seal of trust” in the financial world.

Regulatory Core: AMLA and FINMA

AMLA is the cornerstone of Switzerland’s anti-money laundering (AML) regime, requiring all financial intermediaries to carry out rigorous Know Your Customer (KYC) checks and file Suspicious Activity Reports (SARs).

FINMA, the key enforcement body, oversees banks, asset managers, and other financial entities to ensure compliance with world-class AML standards. It has broad enforcement powers, including fines, corrective orders, trading bans, and license revocation—ensuring airtight compliance.

Detailed Regulations: AMLO and AMLO-FINMA

The precision of AMLA is further reinforced through subsidiary regulations:

- AMLO (Ordinance of the Federal Council on Combating Money Laundering and Terrorist Financing): General rules for all financial intermediaries.

- AMLO-FINMA (FINMA’s AML Ordinance): Specific rules for institutions directly supervised by FINMA, such as real-time monitoring of high-risk transactions.

This layered regulatory design ensures comprehensive oversight with no blind spots.

New Regulations: FinSA and FinIA

Following the global financial crisis, Switzerland unified its regulatory requirements under the principle of “same business, same risks, same rules” to ensure fairness and rigor. The Financial Services Act (FinSA) and the Financial Institutions Act (FinIA) came into force in January 2020, forming the core of Switzerland’s modern financial market framework.

- FinSA governs conduct of business, including identity verification during client onboarding, aligning with AMLA’s KYC requirements.

- FinIA outlines licensing and supervision for financial institutions, mandating internal compliance systems in line with AMLA.

Together, these ensure thorough regulatory coverage.

Tripartite Supervision: FINMA, SOs, and Institutions

Under FinIA, Switzerland introduced a unique tripartite supervision model, involving:

- FINMA (licensing and enforcement)

- Supervisory Organizations (SOs) (daily oversight)

- Regulated Institutions (compliance responsibilities)

This collaborative structure combines efficiency and rigor.

Dual-System: FINMA + SRO

For smaller entities not directly supervised by FINMA, Switzerland uses Self-Regulatory Organizations (SROs), which are authorized and overseen by FINMA. SROs monitor members’ compliance with AMLA and AMLO, and report violations to FINMA. Under FinIA, SROs also play a regulatory role in portfolio management, and their members must follow FinSA conduct standards.

This “FINMA + SRO” dual system ensures tight regulatory control at every level.

In short, the credibility of Swiss licenses stems from a comprehensive legal system led by AMLA and FINMA. From detailed AML rules (AMLO, AMLO-FINMA) to modern regulations (FinSA, FinIA) and efficient oversight mechanisms (tripartite supervision, SROs), Switzerland has built a multi-layered, airtight compliance network. For VASPs, this represents not just high compliance standards, but a globally recognized badge of trust.

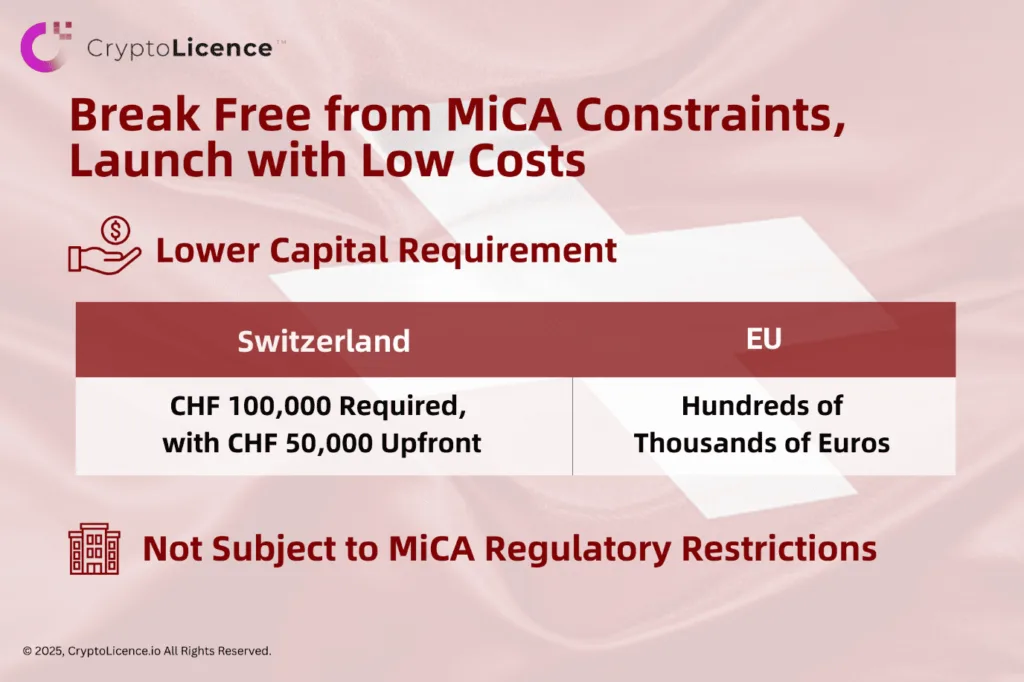

Advantage 2: Escape MiCA Burdens, Start with Lower Costs

Compared to the EU, Switzerland offers significant entry-level advantages for VASPs. It has lenient capital requirements—small firms only need CHF 100,000 in minimum capital, with just CHF 50,000 paid upfront, far lower than the hundreds of thousands of euros often required under the EU’s Markets in Crypto-Assets (MiCA) regulation.

Even more crucially, as a non-EU country, Switzerland is not bound by MiCA, avoiding its heavy compliance burden. This gives VASPs greater operational flexibility and cost advantages.

Moreover, Switzerland allows financial intermediaries to trade on behalf of both themselves and their clients—a right that, under EU rules, requires a CHF 750,000 capital reserve. This combination of low thresholds and policy freedom accelerates market entry, making Switzerland the ideal choice for VASPs seeking a fast and flexible start.

Advantage 3: Flexible SRO Membership Accelerates Market Entry

Among the various licensing options in Switzerland, SRO membership stands out for its convenience—making it the go-to choice for VASPs. Compared with FINMA licenses or the EU MiCA regime, SROs offer:

- Fast-track compliance: Take VQF (Financial Services Standards Association) for example—an SRO authorized by FINMA. The entire application process takes just 4–5 months, much faster than the ~1 year for FINMA or 6–12 months under MiCA, giving VASPs a vital head start.

- Low entry cost: Initial costs are just a few thousand CHF—VQF’s joining fee is about CHF 5,000, with flexible annual fees. This is significantly cheaper than FINMA’s CHF 100,000+ or MiCA’s high six-figure euro requirements.

- Convenience without compromising credibility: Though SRO licenses are known for their ease, they don’t compromise on compliance. Supervised by FINMA and aligned with AMLA standards, SRO members enjoy global recognition for their regulatory integrity.

- Smooth scalability: As VASPs grow, their strong compliance base under an SRO allows seamless upgrade to direct FINMA regulation—avoiding the need to restart the licensing process from scratch, unlike MiCA’s heavy reapplication process.

SROs combine low cost and high efficiency, significantly reducing barriers for entry. They offer a stress-free compliance path—ideal for SMEs looking to launch operations quickly.

Contact Us Now to Obtain Your Swiss SRO Membership!

In short, Swiss licensing offers strong credibility through strict regulations, low barriers and regulatory flexibility for smooth market entry, and it’s fast, affordable compliance via SROs. Together, these make Switzerland the ultimate springboard for VASPs entering the global crypto market.

Want to learn more about Swiss SRO membership? Get in touch with your European crypto and financial licensing expert—CryptoLicence!