Tether’s Move Signals the Future: Secure a Salvadoran License and Tap into the $2 Trillion Stablecoin Market

Table of Contents

Stablecoins are fast becoming the “digital dollar” connecting global payments with the crypto economy. Their explosive potential is fueling the next wave of financial transformation. Whoever secures regulatory access first will be in prime position to benefit from stablecoins’ role in cross-border payments, crypto trading, and asset allocation.

As regulatory pressure increases in jurisdictions like the U.S. and Hong Kong, Tether’s bold move to relocate its headquarters to El Salvador sends a clear signal: El Salvador is emerging as the new global center for stablecoin strategies. For crypto firms seeking low-cost, compliant global expansion, now is the golden window to capture this trend and replicate Tether’s playbook.

Global Regulatory Race: The Era of Stablecoin Licensing Is Here

Stablecoins are rapidly reshaping the global financial system. From the U.S. and EU to Hong Kong and Singapore, regulators are rolling out frameworks to bring stablecoins into the mainstream. 2025 is shaping up to be the year of regulatory normalization for stablecoins—marking the transition from a “grey zone” to licensed market operations.

- 1:1 reserve backing is mandatory, with reserves held in segregated custody by regulated financial institutions.

- AML/CTF compliance is required; only licensed Permitted Payment Stablecoin Issuers (PPSIs) may issue stablecoins.

- Stablecoins are categorized as EMTs (E-Money Tokens) or ARTs (Asset-Referenced Tokens).

- Issuers must be licensed, publish whitepapers, and disclose reserves.

- Emphasis on transparency, redemption rights, and reserve management.

- Requires full reserve backing and custody at regulated entities.

- Licenses granted only to qualified financial institutions.

- Designed to support cross-border RMB trade settlement and financial integration.

- Firms will fall under capital, governance, and transparency obligations.

- Draft rules expected mid-2025; final rules by year-end.

- Stablecoin payment usage not yet part of licensing but under long-term policy planning.

- The UK aims to become a global crypto asset hub, with regulated stablecoins playing a central role in trusted digital payments.

- Introduces Digital Token Service Provider (DTSP) category.

- Stablecoin issuers must obtain dedicated licenses, meet capital, AML/CTF, and cybersecurity standards.

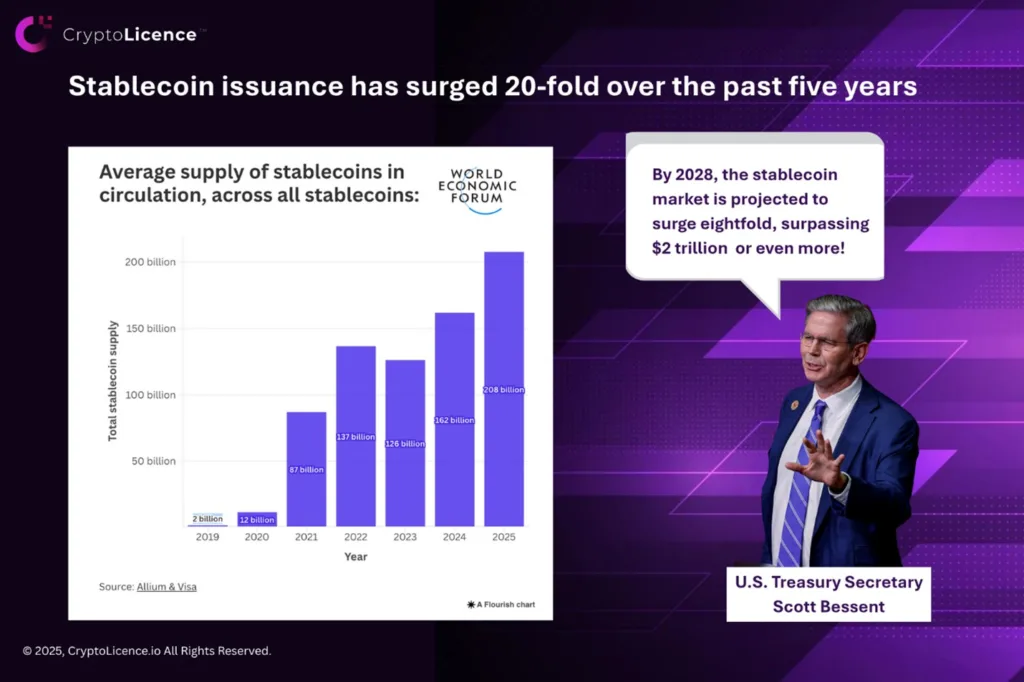

The $2 Trillion Opportunity: Stablecoins Reshape Global Finance

- Stablecoin issuance has surged over 20x in the past 5 years.

- Scott Bessent forecasts the market will surpass $2 trillion by 2028.

- Use cases span cross-border payments, DeFi liquidity, trade finance, digital asset investment, and more.

- PayPal and Visa have integrated stablecoins for instant global settlement.

- JPMorgan, Citibank, and Ant Group are deploying institutional stablecoin infrastructure.

- In high-inflation regions, stablecoins are becoming digital dollars for financial inclusion.

- By 2025, DeFi is projected to exceed $300 billion, with stablecoins providing over 50% of its liquidity.

Tether Bets on El Salvador to Gain the Global Stablecoin Edge

In January 2025, global stablecoin leader Tether made headlines by obtaining a DASP (Digital Asset Service Provider) license from El Salvador and relocating its headquarters there. The move is strategic: to establish a low-cost, compliant global operating base and further solidify the dominance of USDT and XAUT.

- USDT market cap: over $160 billion, holding 60%+ market share.

- XAUT: gold-backed stablecoin targeting inflation-hedging investors.

- Blockchain reach: Supports Ethereum, Solana, Tron, enabling multi-chain liquidity for trading and DeFi.

Comprehensive Guide to El Salvador’s DASP and BSP Licenses

| Advantage | Explanation |

|---|---|

| Zero Tax Incentives | No corporate income tax, capital gains tax, or VAT on digital assets |

| Fast Approval, Low Cost | Only $2,000 capital required, licensing in as little as 6 months; virtual office and non-resident structures allowed |

| Flexible Business Scope | DASP covers stablecoin issuance, exchanges, custody, derivatives, NFTs; BSP focuses on Bitcoin-related services |

| FATF-Compliant | Aligns with global AML standards, easing cross-border banking and payments integration |

| Strong Government Support | Presidential support for crypto mining, infrastructure, and investment |

Compared to the capital-intensive requirements of the U.S. GENIUS Act or EU’s MiCA, El Salvador offers a faster, cheaper, and more flexible path—ideal for SMEs and Asia-based crypto firms.

Ride the Stablecoin Wave — El Salvador Is Your Launchpad to Global Expansion

As the stablecoin market continues to surge, El Salvador stands out as a cost-effective, fast-track, and compliant hub for global operations.

Contact our expert team today for a free consultation and take the first step toward securing your license, entering the market, and building a trusted, future-ready crypto business.