Seizing the On/Off-Ramp Opportunity: A Winning Strategy for Cross-Border Payments

Table of Contents

In 2024, global cryptocurrency trading volumes surged, driving explosive growth in fiat-to-crypto conversion services. Today, the exchange between fiat and digital assets has become a rising trend in the cross-border payments sector.

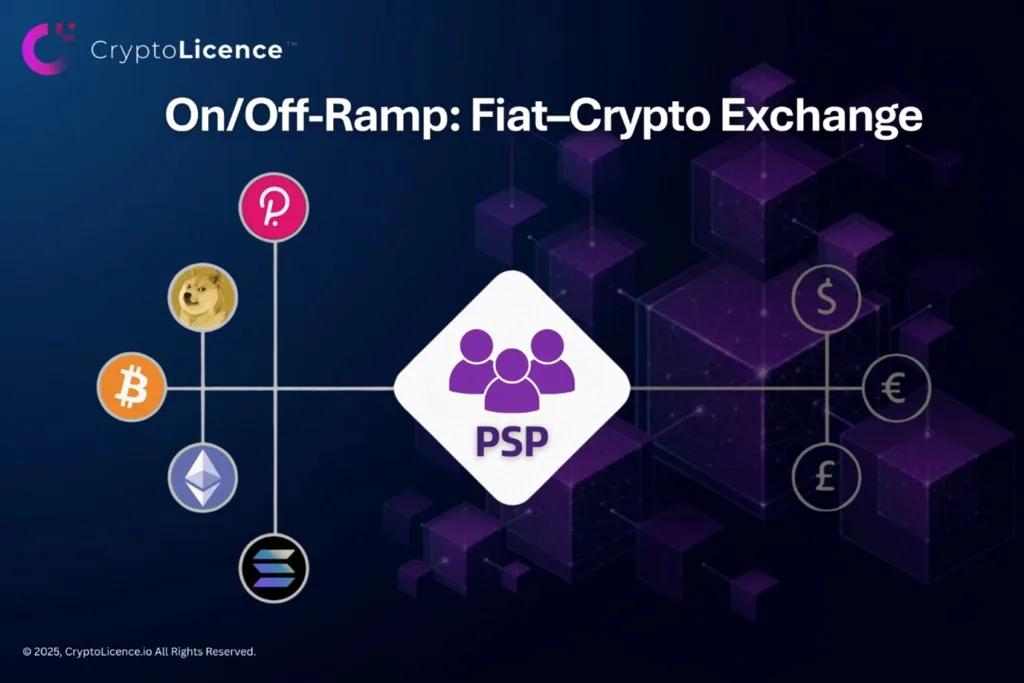

On-Ramp services enable users to conveniently purchase cryptocurrencies with fiat, while Off-Ramp solutions allow digital assets to be quickly converted into cash — effectively bridging the gap between traditional finance and the crypto economy. However, with increasingly complex global regulations, companies must prioritize compliance when expanding in this space.

To meet this growing demand, CryptoLicence offers a comprehensive compliance solution for fiat-to-crypto conversion. Leveraging licensed institutional partners, professional licensing services, and a global network of collaborators, we help businesses navigate regulatory challenges efficiently and seize early market opportunities.

On/Off-Ramp: Reshaping the Future of Cross-Border Payments

Amid intensifying competition among global Payment Service Providers (PSPs), On-Ramp and Off-Ramp services for fiat and cryptocurrency exchange are rapidly emerging as a new trend in cross-border payments.

On-Ramp allows users to purchase digital assets (such as Bitcoin or Ethereum) using fiat currencies (like USD or EUR), while Off-Ramp enables users to efficiently convert their crypto holdings back into fiat — achieving seamless two-way capital flows.

This new exchange model not only significantly enhances the flexibility and efficiency of fund transfers but also bridges the gap between traditional finance and the rapidly evolving crypto economy. It offers more accessible and compliant solutions for investors, cross-border remittance users, and digital payment participants alike.

As the cryptocurrency market continues to thrive, On/Off-Ramp services are reshaping the global payment landscape. According to CoinGecko, centralized exchange spot trading volume reached USD 18.83 trillion in 2024 — a 134% year-on-year increase. Meanwhile, the total crypto market capitalization grew from USD 1.72 trillion at the beginning of the year to USD 3.36 trillion, marking a remarkable 95.2% rise.

At the same time, the use of crypto assets in cross-border payments is accelerating, prompting Payment Service Providers (PSPs) to rapidly roll out On/Off-Ramp solutions in a race to capture early market share.

Both emerging blockchain firms and traditional financial institutions are actively entering the space, aiming to enhance user experience and expand market presence through efficient and compliant asset conversion services.

BCB Group, a recognized leader in crypto payments, provides fiat-to-crypto exchange services specifically for institutional clients. By establishing deep integrations with global banks and exchanges, it delivers a low-latency, high-security trading environment trusted by hedge funds and corporate customers.

MoneyGram, a traditional payment services giant, has partnered with Stellar blockchain to launch fiat-to-crypto conversion services. This move significantly enhances its cross-border remittance capabilities and has attracted a large user base from emerging markets — highlighting the broader trend of traditional finance transitioning into the crypto economy.

Meanwhile, Circle, the issuer of USDC, is leveraging its enterprise payment solutions to offer multi-currency settlement and instant On/Off-Ramp services for global e-commerce and fintech companies.

These strategic moves by industry leaders demonstrate that On/Off-Ramp is no longer just a technical feature — it is fast becoming a key driver of innovation in cross-border payments and a critical force reshaping the competitive landscape.

Compliance & Regulation: The Key to Unlocking On/Off-Ramp Business

To gain a foothold in the On/Off-Ramp market, regulatory compliance is the cornerstone of success. Since On/Off-Ramp services involve two-way conversion between fiat and crypto assets—spanning both traditional finance and the crypto economy—they are subject to strict oversight across various jurisdictions.

Regulatory requirements vary significantly by region. In the European Union, under the Fifth Anti-Money Laundering Directive (5AMLD), Virtual Asset Service Providers (VASPs) must register and comply with stringent AML and KYC obligations, including customer due diligence and transaction recordkeeping. In the United States, companies must register at the federal level as Money Services Businesses (MSBs) and obtain state-level Money Transmitter Licenses (MTLs), such as the well-known BitLicense in New York.

Against this backdrop, Hong Kong’s Money Service Operator (MSO) licence has become a preferred option for many Payment Service Providers (PSPs) and crypto companies, thanks to its high international recognition and broad applicability. Issued by the Hong Kong Customs and Excise Department (C&ED), the MSO licence legally authorizes companies to conduct currency exchange and cross-border remittance services—providing a compliant gateway for On/Off-Ramp operations.

As a global financial hub, Hong Kong offers robust financial infrastructure and a mature regulatory environment, making it an ideal launchpad for entering the On/Off-Ramp space. However, due to booming interest in the crypto sector, demand for the MSO licence has surged, while approval standards have tightened significantly. As of May 2025, only around 1,100 companies hold valid MSO licences, and application thresholds are now much higher than before.

For businesses aiming to enter the market quickly, these strict requirements present real challenges. Complex corporate structures, incomplete compliance documentation, or a lack of a clear business plan can all lead to application rejections or delays.

Partner with CryptoLicence to Launch Your On/Off-Ramp Strategy Today

In the rapidly evolving On/Off-Ramp cross-border payment sector, businesses face dual challenges: complex regulatory requirements and increasing demands for market compliance. Choosing an experienced compliance partner with global insight is crucial to ensuring smooth market entry and sustainable growth.

CryptoLicence offers a one-stop solution powered by a professional team, multi-jurisdictional licensing expertise, and a robust compliance network. From licence application and corporate structuring to ongoing regulatory support, we help businesses enter the market quickly, build a strong compliance foundation, and stay ahead in a highly competitive landscape.

CryptoLicence empowers clients to fast-track their On/Off-Ramp operations through access to ready-made licensed entities, including Hong Kong MSO licences. This allows businesses to meet regulatory entry requirements without going through lengthy approval processes—enabling immediate and compliant market launch.

We also offer professional licensing application services across multiple jurisdictions, covering virtual asset licences and cross-border payment permits. For clients starting from scratch, we provide end-to-end support—from regulatory analysis and documentation preparation to interview coaching and application follow-up—ensuring both speed and success in licence acquisition.

Leveraging our global compliance resources and industry network, CryptoLicence can further assist in setting up bank accounts, payment channels, and essential financial integrations, significantly reducing the time to launch On/Off-Ramp services.

Now is the ideal time to enter the On/Off-Ramp market. Contact CryptoLicence today for a tailored solution that is compliant, efficient, and built for long-term success—let us help you unlock the next chapter of cross-border payments.