MiCA General ACT Overview

What is MiCA?

The European Union’s Market in Crypto Assets (MiCA) Regulations is the world’s first comprehensive legal framework for the issuance and trading of crypto-assets. The regulatory milestone aims to make the crypto industry in the Eurozone a transparent and secure environment for investors and consumers. MiCA Regulations apply to crypto asset issuers and service providers.

The key objectives of MiCA are:

- To replace individual regulations found within several EU nations with one unifying and comprehensive framework

- To set clearer rules for crypto-asset service providers and token issuers

- To provide more certainty in the regulation of crypto assets where it is not covered by the existing financial regulations

Who falls under MiCA?

The crypto-asset service providers (CASPs) that fall under MiCA include:

- Custodial wallets

- Exchanges for crypto-to-crypto transactions or crypto-to-fiat transactions

- Crypto-trading platforms

- Execution of orders for crypto assets on behalf of clients

- Reception and transmission of orders for crypto assets on behalf of clients

- Crypto-asset advising firms and crypto-portfolio managers

In terms of assets applicability, MiCA covers three types of assets:

- Asset-referenced tokens (including stablecoins backed by commodities, or one or several currencies)

- E-money tokens (stablecoins backed by a single fiat currency)

- Other tokens, including utility tokens

Who is out of scope?

MiCA explicitly excludes crypto-assets that are unique and not fungible with other crypto-assets. Therefore, in relation to most NFTs, MiCAR will not apply. However, MiCA may apply to NFTs whose characteristics make it more likely to be fungible (e.g., NFTs issued in series or as a collection).

Crypto-asset services which are fully decentralised are not covered by MiCA. Therefore, for example – the world’s most well-known cryptocurrency, that is Bitcoin – is not itself regulated by the MiCA Regulation.

Other than that, MiCA does not apply to the following types of assets, which qualify as:

- Financial instruments;

- deposits, including structured deposits;

- funds, except if they qualify as e-money tokens;

- unique and not fungible with other crypto-assets (as stated above, that includes certain NFTs);

- non-life or life insurance products;

- social security schemes.

Who regulates MiCA?

In the context of MiCA, the European Securities and Markets Authority (ESMA) plays a key role in interpreting the provisions and ensuring consistent application across EU member states. ESMA is responsible for developing regulatory technical standards, providing guidance, and overseeing the implementation of MiCA to ensure that crypto-asset service providers comply with the rules and that market integrity is maintained within the EU’s crypto-asset sector.

While national competent authorities (NCAs) are responsible for overseeing application and authorisation of CASPs (crypto-asset service providers), ESMA will work with NCAs on a convergent approach to authorisation of crypto-asset service providers (CASPs) during the transitional phase to ensure the supervisory expectations are aligned across the European Economic Area.

The NCA is responsible for deciding whether to approve CASP applications. Upon approval, the NCA will notify ESMA, which will then proceed with registration and publication.

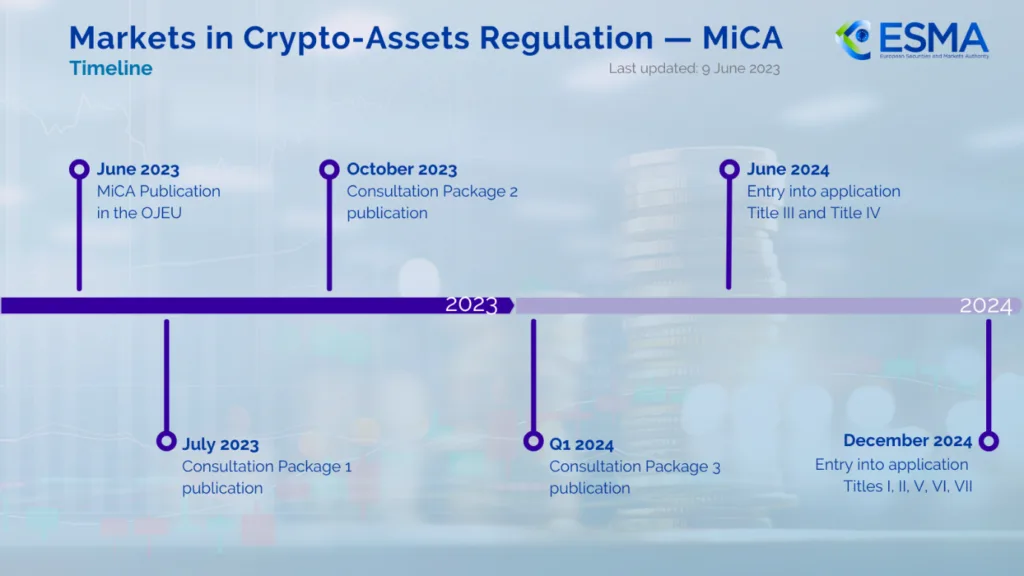

When does MiCA come to force?

The part of the MiCA Regulation relating to stablecoins (Chapters III and IV) entered into force on 30 June 2024, while the rest of the MiCAR will enter into force on 30December 2024.

What is Transactional Period?

The transitional period is a defined timeframe during which existing Virtual Asset Service Providers (VASPs), as well as those intending to operate as VASPs, can continue providing services in compliance with their country’s national legislation. During this period, these providers must also take the necessary steps to complete the CASP authorization process. Each Member State should align its national laws with the MiCA provisions within this timeframe.

Member States have the discretion to opt out of this transitional period or to shorten it if desired. The European Securities and Markets Authority (ESMA) recommends that this period should not exceed 12 months.

What is the transaction period for different European countries?

| Member States | Transaction Period |

|---|---|

| Austria | Until 31 December 2025 |

| Belgium | No Information* |

| Bulgaria | No Information* |

| Croatia | Until June 2026 |

| Republic of Cyprus | No Information* |

| Czech Republic | Until 1 July 2026 |

| Denmark | Until 1 July 2025 |

| Estonia | Until 1 January 2026 |

| Finland | Until 30 June 2025 |

| France | Until 1 July 2026 |

| Germany | Until 31 December 2025 |

| Greece | No Information* |

| Hungary | No transaction period |

| Ireland | Until 31 December 2025 |

| Italy | Until 30 December 2025 |

| Latvia | Until 30 June 2025 |

| Lithuania | Until 1 June 2025 |

| Malta | No Information* |

| Netherlands | Until 1 July 2025 |

| Poland | Until 30 June 2025 |

| Portugal | No Information* |

| Romania | No national regulation of VASPs |

| Slovakia | No Information* |

| Slovenia | Until 01 July 2026 |

| Spain | Until 12 months |

| Sweden | Until 30 September 2025 |

VASP vs. CASP Application Requirements

| VASP | CASP | |

|---|---|---|

| Local Registration | ✔ | ✔ |

| Application Form & Document | ✔ | ✔ |

| Physical Office | ✔ | |

| Local Director | ✔ | |

| Local MLRO | ✔ | |

| Bank Account | ✔ |

VASP vs. CASP Document Requirements

| VASP | CASP | |

|---|---|---|

| Articles of Association | ✔ | ✔ |

| Management and Shareholder Information | ✔ | ✔ |

| Business Plan | ✔ | ✔ |

| Business Continuity Plan | ✔ | |

| AML/CTF Policy | ✔ | ✔ |

| Internal Control Policy | ✔ | |

| IT Security Policy | ✔ | |

| Safeguarding Policy | ✔ | |

| Client Fund Segregation Policy | ✔ | |

| Platform Operation Rules and Abuse Monitoring Plan | ✔ | |

| Crypto Asset or Fiat Currency Exchange Solution | ✔ | |

| Crypto Asset Consultation and Management Solution | ✔ | |

| Client Order Execution Guidelines | ✔ | |

| Complaint Handling Process | ✔ |

Cost Comparison

| VASP | CASP | |

|---|---|---|

| Business Registration Cost | Virtual office only: Lower cost, approximately $50–$100/month. | Physical office required: Higher cost depending on location, approximately $300–$800/month. |

| Licence Application Cost | Lower cost for less requirements. | Higher cost for more extensive documentation requirements. |

| Corporate Bank Account Opening Cost | Not mandatory. | Mandatory, financial institutions charge approximately $1,000–$5,000; traditional banks typically charge $5,000 or more. |

| Local Director Salary | Not mandatory in some cases. | Nominee directors cost approximately $1,000–$3,000/month, depending on their background and experience. |

| Local AML Officer Salary | Not mandatory in some cases. | Nominee AML officers cost approximately $1,000–$3,000/month, depending on their background and experience. |

Why Choose Us?

- We manage the licence upgrade project and ensure timely progress.

- We draft all the necessary documents required for the licence upgrade.

- We provide training to your team to prepare for regulatory interviews and questions.

- We assist in recruiting local directors, AML compliance officers, and other key personnel.

- We help find the most suitable local office space.

- We assist with account opening, from introductions and due diligence to account setup and maintenance.

- We offer support in maintaining compliance post-licence approval.

Contact us to know more!

Other Recommended Licences

Switzerland

Renowned for its strong reputation and offering the most comprehensive functionality for crypto services.

Canada

A cost-effective license to conduct both payment and crypto activities, making it attractive for new market entrants.

El Salvador

A pioneering country in the adoption of Bitcoin as legal tender, fostering crypto-friendly opportunities.

Slovenia

A stable jurisdiction with a longer transitional regulatory period (from VASP to CASP) until July 2026.

What Clients Say About Our Services

About CryptoLicence

CryptoLicence specializes in simplifying the registration and licensing process for crypto businesses in El Salvador and other global markets. We are committed to helping crypto businesses, startups and investors navigate complex regulatory landscapes with ease, ensuring full compliance and smooth market entry.

With in-depth knowledge of key markets, we provide tailored compliance solutions for businesses in regions such as Hong Kong, Singapore, Malaysia, Europe and North America. Our expertise spans popular licenses, including the Czech Republic VASP license, Swiss SRO, Polish VASP, and Salvadoran cryptocurrency licenses. Our global network and understanding of local practices give your business a competitive edge.

We recognize the unique challenges international startups face, from navigating regulations and cross-border compliance to overcoming cultural and language barriers. CryptoLicence is here to offer end-to-end support, from interpreting the latest regulations to providing comprehensive compliance solutions. Our goal is to make the licensing process seamless, empowering you to expand your crypto or FinTech venture in El Salvador and beyond.

Your Crypto Licence Consultants

Guiding Your Path to Compliance in El Salvador and Beyond

Sheldon | Director

Sheldon is a seasoned FinTech professional with 7 years of experience specializing in cross-border payments and cryptocurrency licensing, spanning from the web2 to web3 era. He has successfully managed over 30 projects, delivering expertise in payment and cryptocurrency license applications. With a strong network of strategic partnerships, Sheldon brings valuable connections and resources to every endeavor.

Connect with Sheldon on LinkedIn

Jing C | Consultant

Jing is a skilled professional specializing in project management for regulatory compliance and financial institution business development. Currently handling licensing requests in Czech and Switzerland, he also brings a strong legal background in dispute resolution to his work.

Connect with Jing on LinkedIn

Boo | Consultant

Boo offers expertise in handling UK API and Hong Kong MSO license applications, as well as maintaining the Poland VASP license. With his previous experience as an analyst at a family office VC fund, he brings a valuable skill set to the firm.

Connect with Boo on LinkedIn

Cing | Consultant

Cing Hui is a corporate and commercial law specialist with expertise in overseas company formation, customized business solutions, and legal counsel. She currently specializes in MSB (Money Service Businesses) license applications for Canadian and American entities.

Connect with Cing on LinkedIn