Hong Kong’s Stablecoin Regulation Takes Effect — Are Ready-Made MSO Licenses the New Fast Track to Compliance?

Table of Contents

As of August 1, 2025, Hong Kong’s Stablecoins Ordinance has officially come into effect, marking a new chapter for the digital asset industry. In the past month alone, more than 10 Hong Kong-listed companies have raised over USD 1.5 billion through share placements, with proceeds earmarked for stablecoin, digital asset, and blockchain payment projects. Capital inflows, regulatory support, and strong market demand are now converging, making regulatory compliance the key to entering Hong Kong’s evolving Web3 ecosystem.

Stablecoins Attract Significant Institutional Capital

With Hong Kong opening applications for stablecoin issuer licenses, fintech companies are actively seeking funding and expanding their crypto-related operations. This investment surge signals high market confidence in the future of stablecoins and underscores Hong Kong’s position as a front-runner in the global race for crypto regulatory leadership.

According to Reuters, at least 10 listed companies raised over USD 1.5 billion in July 2025 through equity placements. Notable participants include digital asset exchange OSL Group, cloud retail provider Dmall Inc, and AI firm SenseTime Group. The majority of funds are being directed towards stablecoins, digital assets, and blockchain payment infrastructure, highlighting a strong institutional interest in these sectors.

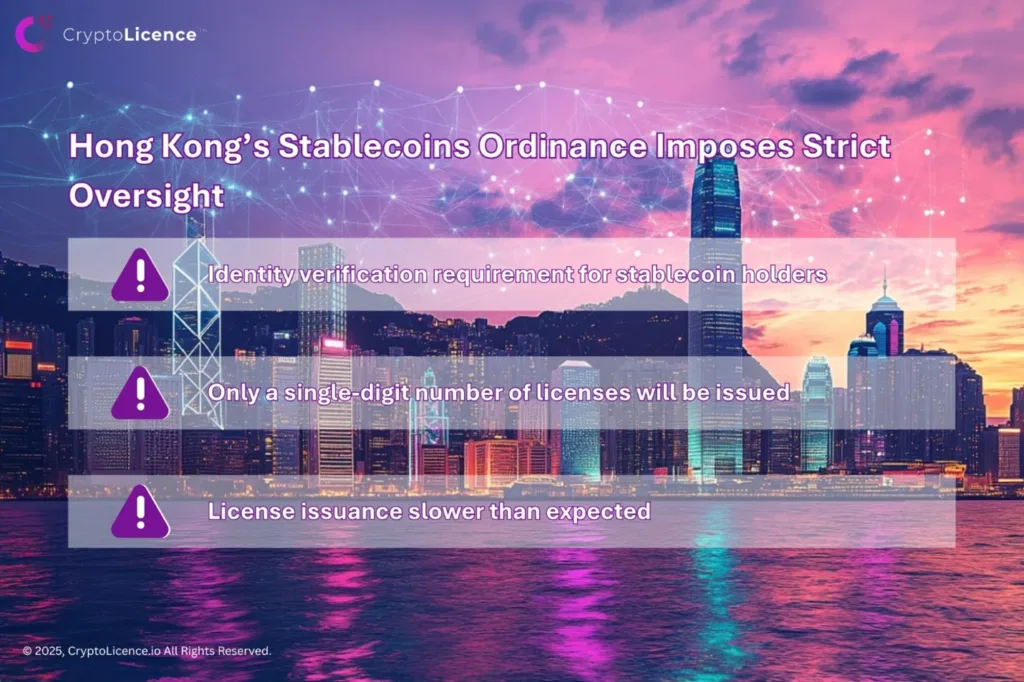

Implementation of Hong Kong’s Stablecoins Ordinance

This funding wave coincides with the official launch of the Stablecoins Ordinance on August 1, 2025. Passed in May 2025, this legislation positions Hong Kong as a regulated stablecoin market capable of competing with jurisdictions like the U.S., attracting global digital asset projects seeking regulatory certainty.

Previously, regulatory ambiguity limited the development of stablecoin initiatives in Hong Kong. The new legal framework provides clarity and boosts market confidence.

Is the Stablecoins Ordinance a Catalyst for Growth or a Regulatory Hurdle?

MSO Licensing Becomes More Challenging Amid Elevated Compliance Standards

- Stringent Review Process: Applicants must submit detailed business plans, technical documentation, AML/KYC policies, and transaction workflows. Live system demonstrations and in-person interviews may be required.

- Difficulties in Bank Account Opening: Even with a license, securing a local bank account is challenging. Banks remain cautious toward MSO license holders lacking robust compliance frameworks.

- Foreign-Controlled Entities Face Increased Regulatory Scrutiny: Applications led by non-Hong Kong residents or lacking local technical teams face longer approval times and lower success rates. Typical timeline for a new MSO license application is 9–12 months, with high costs and procedural complexity.

Ready-Made License Acquisition Emerges as a Strategic Alternative

The Money Service Operator (MSO) license, issued by Hong Kong Customs and Excise Department (C&ED), serves as the regulatory foundation for conducting fiat-to-digital asset conversions (such as HKD/USD to stablecoin), cross-border remittances, and digital wallet services. In light of increasing regulatory challenges, a growing number of companies are adopting a more practical and controlled approach by acquiring ready-made MSO licenses.

This strategy enables firms to gain immediate access to a fully approved and operational license, significantly reducing time-to-market and eliminating much of the regulatory uncertainty. Particularly in the current environment of heightened regulatory scrutiny, acquiring an existing license offers a more secure, flexible, and efficient pathway to market entry.

Five Key Advantages of Acquiring a Ready-Made MSO License:

1. Accelerated Market Entry

Applying for a new MSO license typically takes up to one year. In contrast, acquiring a ready-made license allows for the swift transfer of ownership and operational rights, substantially reducing time-to-market.

2. Avoidance of Application Risk

As regulatory standards tighten, the risk of application rejection has increased. Acquiring a ready-made MSO license eliminates this uncertainty, providing immediate access to a compliant operating framework.

3. Cost-Efficient Setup

Although the purchase price of a ready-made license may be significant, it often delivers better value compared to the cumulative costs of a new license application, which may include staffing, legal fees, office rental, and system development.

4. Facilitated Banking Access

Many ready-made license entities have existing bank accounts in Hong Kong or established relationships with financial institutions. This can enable the acquiring party to assume operations efficiently and begin conducting business without delay.

5. Legal and Compliance Assurance

Through professional due diligence, firms can verify that the licensed entity has no outstanding legal, financial, or compliance risks. This ensures a transparent, controlled, and secure transition of ownership.

Secure Regulatory Advantage and Gain Market Leadership

The implementation of Hong Kong’s stablecoin regulatory framework is not only a policy milestone in its journey toward becoming a global digital asset hub, but also a race driven by speed and regulatory readiness. Firms that secure compliant status early will be best positioned to access key resources, attract capital, and capture market share.

Given the challenges of complex applications, lengthy timelines, and regulatory uncertainty, acquiring a ready-made MSO license presents a more efficient and practical solution. It offers the right balance between regulatory certainty and operational agility.

For companies looking to establish operations in Hong Kong, speed to market is a decisive advantage. As stablecoins gain traction as a new form of currency and digital assets transform global capital markets, securing regulatory approval promptly is essential to capture emerging opportunities.