FDUSD Depegging Sparks Regulatory Concerns? VARA Helps You Move Forward with Confidence!

Table of Contents

Recently, the stablecoin FDUSD experienced a severe depegging, dropping as low as $0.87, causing a public uproar. The controversy was ignited by TRON founder Justin Sun, who alleged that FDUSD issuer First Digital Trust (FDT) is deeply insolvent and even struggling to meet client redemptions.

Even more shocking, Sun accused FDT of illegally misappropriating reserves from another stablecoin, TUSD, involving hundreds of millions of dollars. This not only shook market confidence but also raised concerns about damaging Hong Kong’s reputation as a global financial hub. He sharply criticized weaknesses in Hong Kong’s trust licensing reviews and internal risk controls, urging regulators and law enforcement to intervene swiftly.

The truth behind this turmoil is yet to be revealed, but it raises an important question worth reflecting on: In the fast-paced world of cryptocurrency, what is the true significance of regulation for Virtual Asset Service Providers (VASPs)?

Hong Kong’s Dilemma: Regulation Still Maturing

This incident forces us to confront a reality: despite being a global financial center, Hong Kong’s regulation of cryptocurrency businesses is still developing. The Securities and Futures Commission (SFC) currently focuses on platforms dealing with securities-like virtual assets. However, trust companies like First Digital Trust (FDT), which specialize in stablecoin issuance and asset custody, don’t fully fall under the SFC’s regulatory purview.

While the Hong Kong Monetary Authority (HKMA) is accelerating the development of a regulatory framework for stablecoin issuers, these new rules have yet to be implemented. For now, FDT’s compliance mainly depends on its obligations as a Trust and Company Service Provider (TCSP), rather than a robust framework tailored for digital assets.

This raises concerns—could this regulatory gap become the breeding ground for the next crisis?

The U.S. Breakthrough: SEC Introduces New Guidelines

Looking to the global financial leader, the United States has only just begun to establish a regulatory system for stablecoins. On April 4, the U.S. Securities and Exchange Commission (SEC) released new guidance, stating that “qualified stablecoins” may be exempt from securities registration. This marks a clear regulatory milestone for the industry.

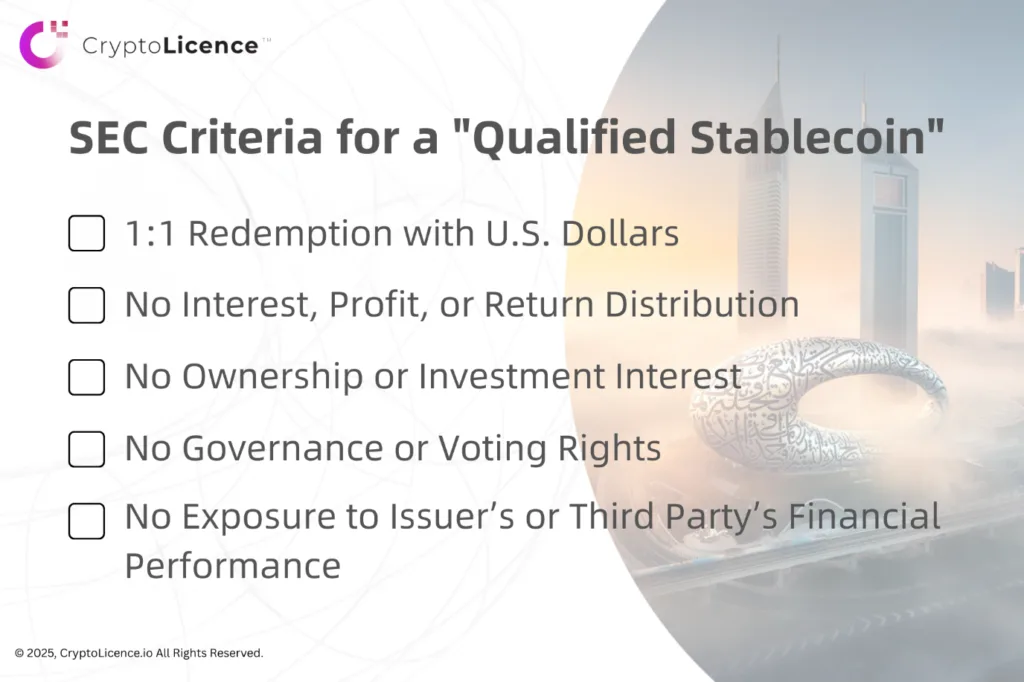

What qualifies as a “qualified stablecoin”? The SEC provides clear criteria, primarily based on marketing intent. These stablecoins must be positioned as tools for payment, funds transfer, or value storage—not as investment products.

In terms of reserve assets, the SEC imposes strict requirements. Qualified stablecoins must be backed by physical U.S. dollars or highly liquid, low-risk assets such as short-term U.S. Treasuries, and must meet the following conditions:

- Reserve assets must be completely segregated from the issuer’s operational funds;

- Must not be used for lending, pledging, re-pledging, or any investment activities;

- Cannot be used for company operating costs or business expenses;

- Must be protected from third-party creditor claims;

- Interest earned on reserves may be retained but must not be distributed to token holders.

To further enhance transparency, the SEC encourages issuers to regularly publish “Proof of Reserves” as a public verification mechanism of financial soundness.

However, this guidance is not a comprehensive solution. While the SEC has relaxed rules for qualified stablecoins, it remains silent on algorithmic stablecoins like Terra and Frax, or stablecoins designed to offer yields. These “alternative players” remain legally ambiguous, and if classified as securities, compliance risks will follow closely. As regulatory boundaries become clearer, the next chapter in the stablecoin market clearly holds more unknowns.

Dubai’s Head Start: VARA Leads the Future

While global regulators are still finding their footing, Dubai has taken the lead. In early 2022, the Virtual Assets Regulatory Authority (VARA) was established—becoming the world’s first independent regulator dedicated to virtual assets. VARA’s bold and clear goal: position Dubai as a global hub for digital assets, enhance its competitiveness in digital finance, and foster a healthy ecosystem through efficient regulation.

VARA not only provides VASPs with a clear compliance path, but also strikes a balance between innovation and security. This forward-looking initiative sets a global benchmark for the crypto industry.

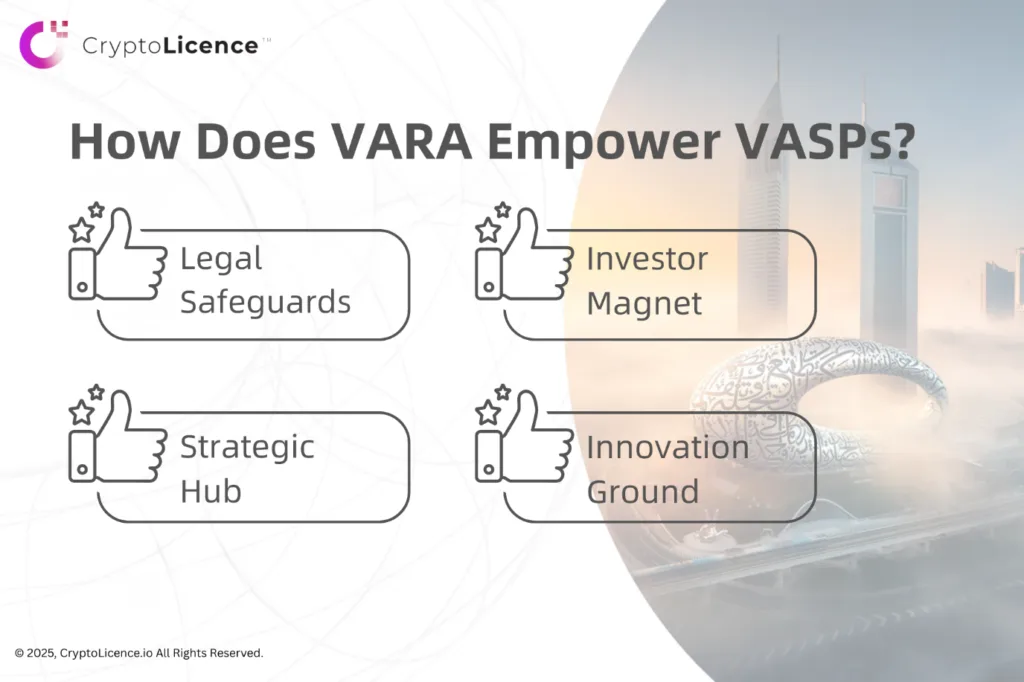

How does VARA empower VASPs?

- Legal Safeguards: It offers a transparent framework, strictly upholding anti-money laundering (AML) and cybersecurity standards to build trust.

- Investor Magnet: A VARA license is a mark of compliance, attracting both local and international capital to energize your business.

- Geographic Advantage: Dubai serves as a golden hub between Asia and Europe, placing your business at the center of global finance with ample opportunities.

- Innovation Ground: The UAE embraces foreign investment and innovation with forward-thinking policies, helping you expand your crypto footprint.

CryptoLicence: Your Guide to VARA Licensing

Want to seize the digital asset opportunity in Dubai? CryptoLicence is your top choice!

- Expert Insight: We understand VARA’s core framework and detailed requirements and provide tailored, end-to-end guidance.

- One-Stop Support: From business plans and AML policies to financial and risk frameworks—we make the licensing process smooth and simple.

- Ongoing Assistance: After licensing, we offer compliance updates, audit support, and banking introductions to keep you ahead of the curve.

The TUSD scandal is a wake-up call—risks are everywhere in the absence of regulation. Dubai’s VARA paves the way for compliant and successful growth. Contact CryptoLicence today to start your new chapter in digital finance!