One License, Dual Use—Save Millions: Can Canada’s MSB and Switzerland’s SRO Launch Both Fiat and Crypto Services Simultaneously?

Table of Contents

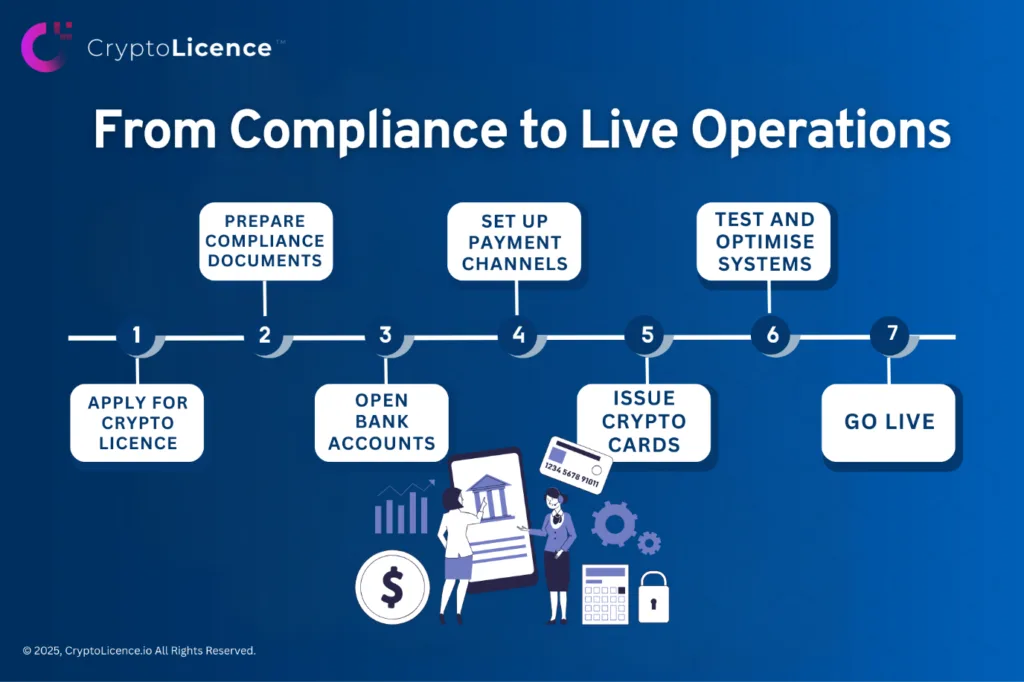

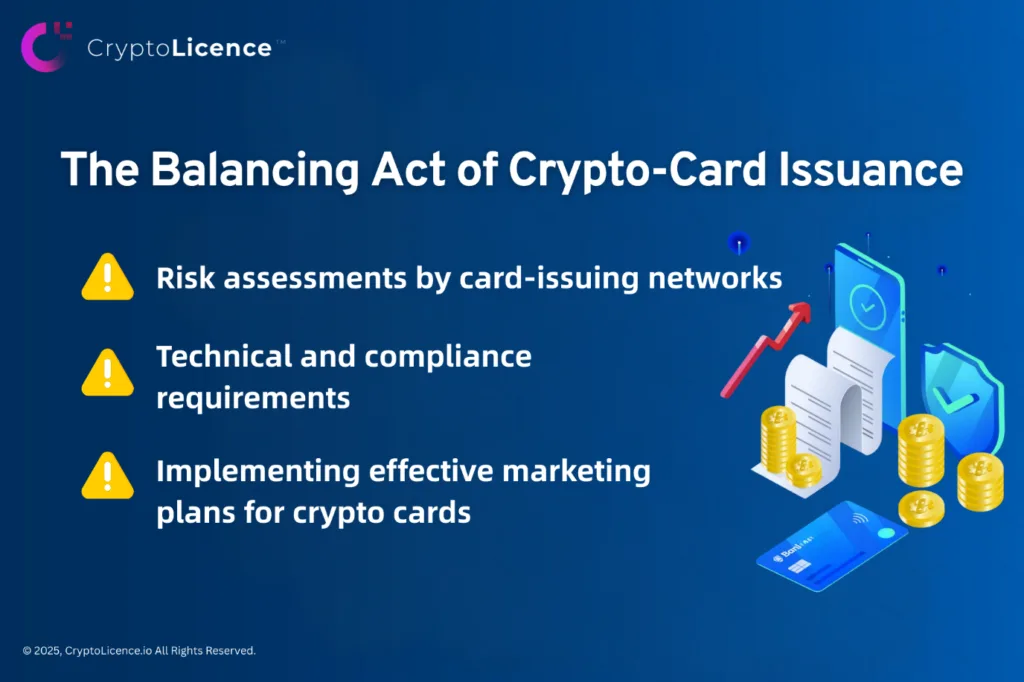

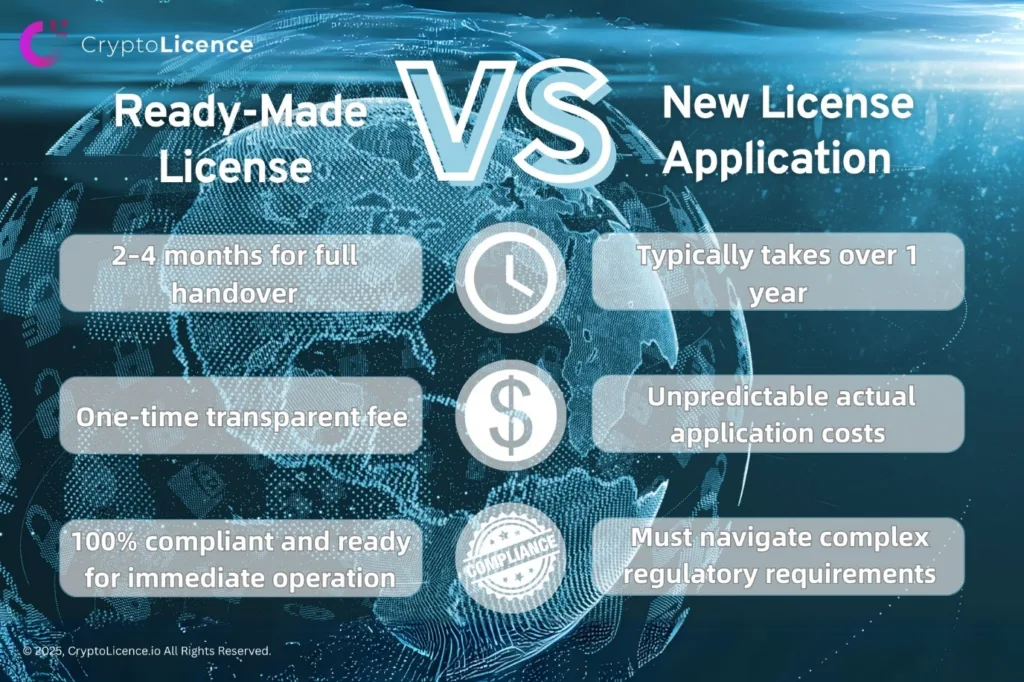

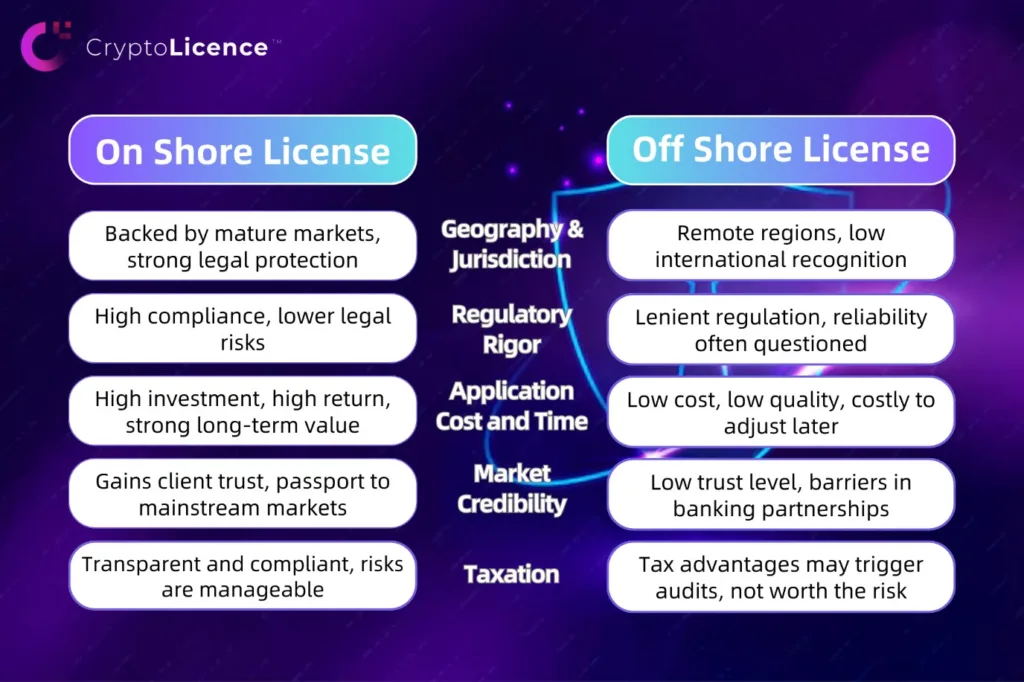

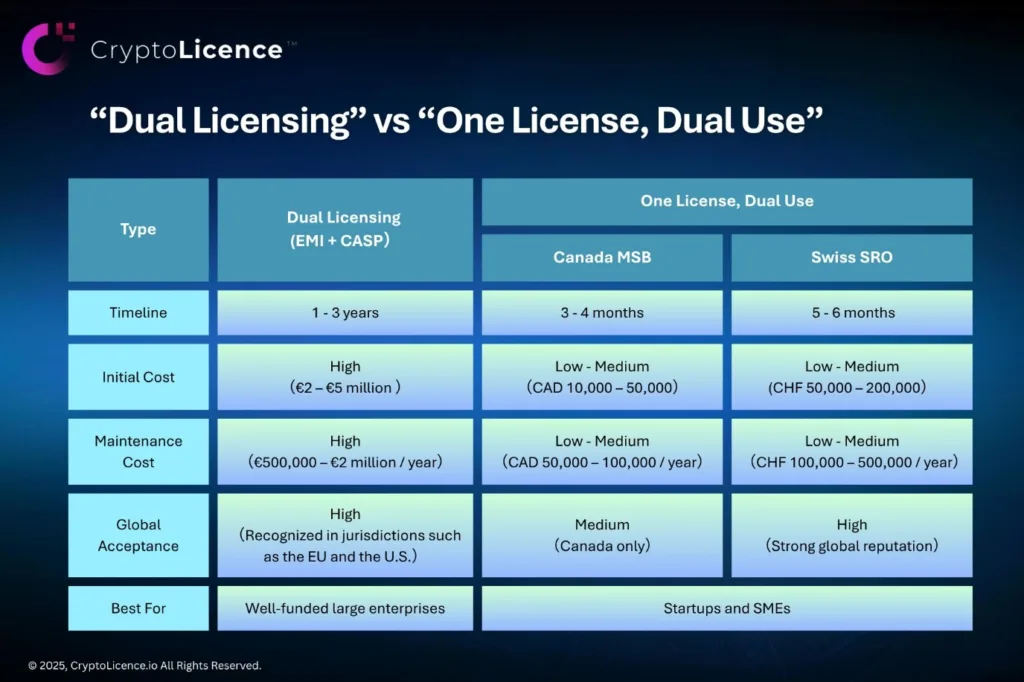

In today’s rapidly evolving fintech landscape, combining fiat and crypto services is quickly becoming a key strategy for gaining competitive advantage. However, the traditional licensing path can be discouraging: applying separately for an Electronic Money Institution (EMI) or Payment Service Provider (PSP) license and a Crypto-Asset Service Provider (CASP) license often takes 1 – 3 years and costs millions of euros. For startups and small to medium enterprises (SMEs), the cost and complexity of compliance present significant barriers to entry.

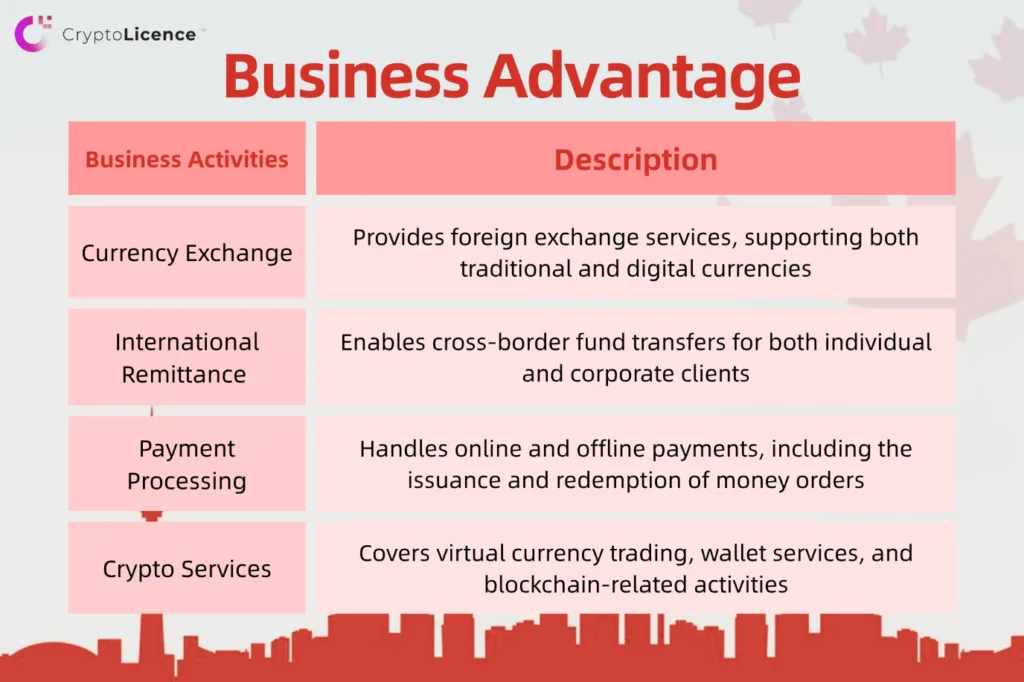

But what if a single license could allow you to operate both fiat and crypto businesses—saving time, cutting costs, and simplifying compliance? That’s the power of the “One License, Dual Use” model. This article breaks down the pain points of traditional dual licensing and explores faster, more cost-effective alternatives such as Canada’s MSB and Switzerland’s SRO models to help you find the most suitable path to compliance.

The Dual-Licensing Burden: Slow, Complex, and Expensive

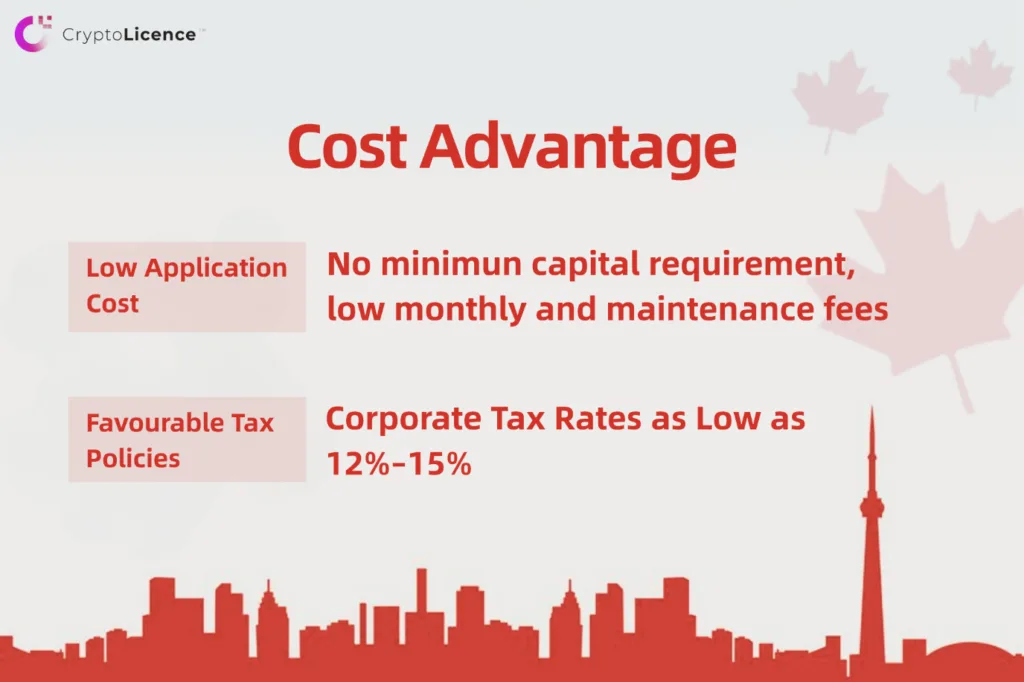

Application and operational costs are often the biggest challenges faced by startups and small fintech companies. In this regard, the Canada MSB license offers significant advantages over financial licenses in the United States and the European Union. Its lower application fees, compliance costs, maintenance expenses, and tax benefits make it a highly competitive option for businesses aiming to expand globally.

1. Long Approval Timelinests

EMI licenses typically take 6 – 18 months, and CASP licenses under the MiCA framework require another 6 – 18 months. Even when pursued in parallel, preparing for both can take up to 3 years. In the fast-paced fintech and crypto markets, that delay could mean missing your window of opportunity.

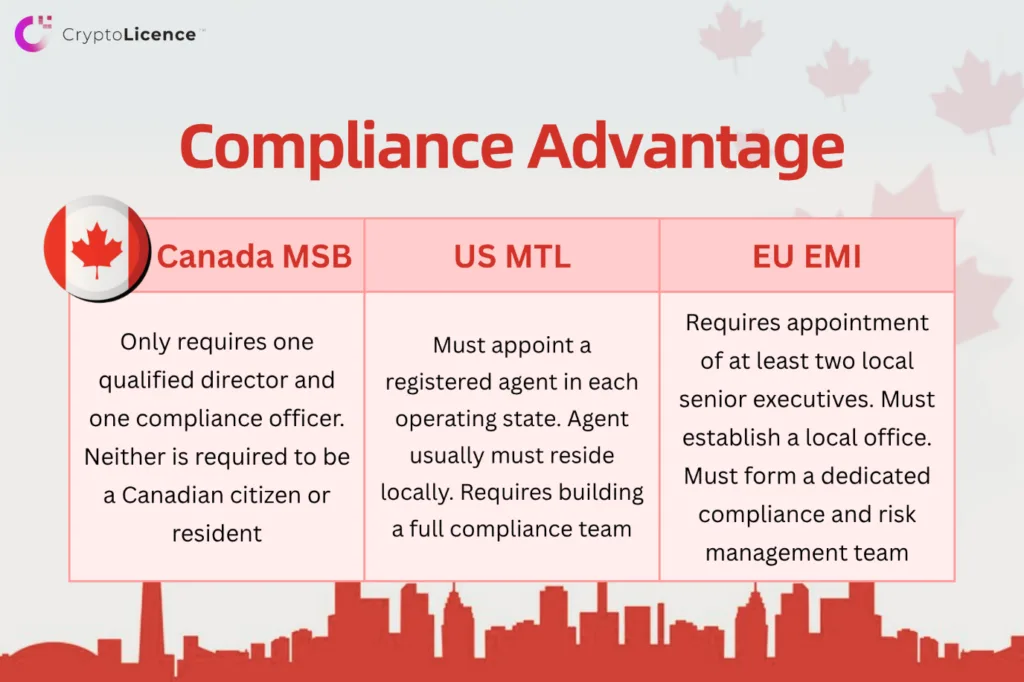

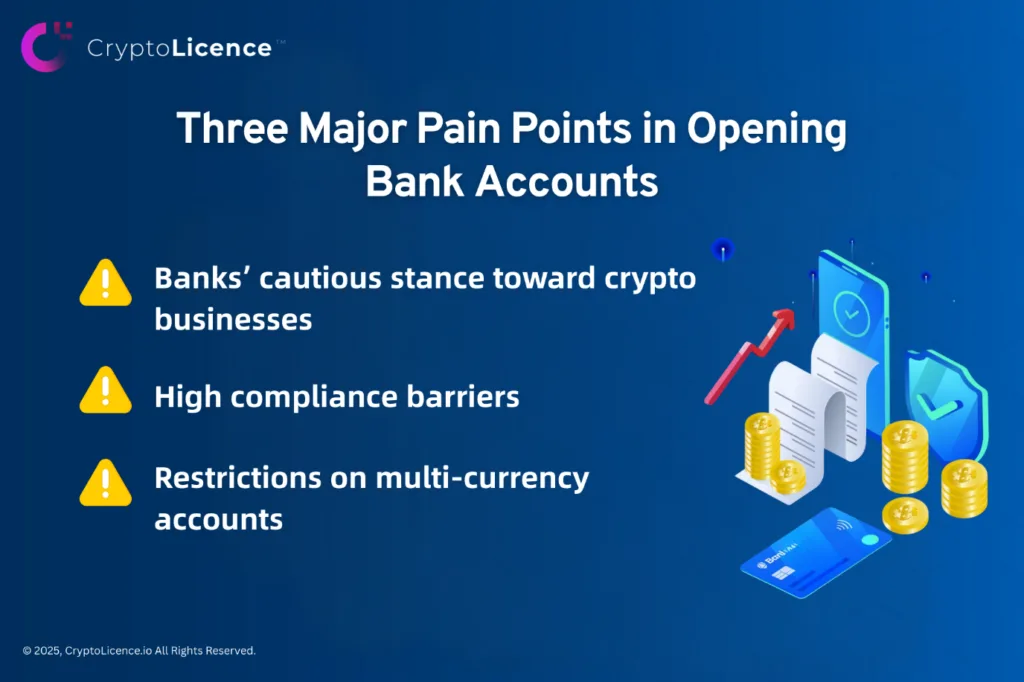

2. Complex Compliance Requirements

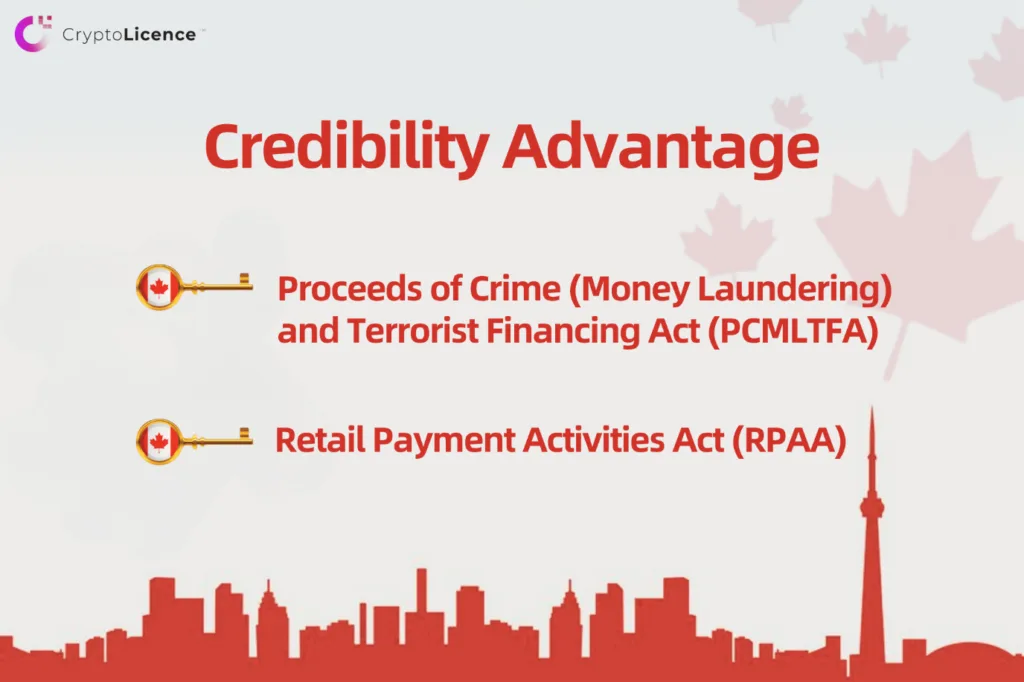

To meet dual-license obligations, companies must build separate KYC and AML/CTF frameworks for fiat and crypto operations, hire dedicated compliance teams, and navigate jurisdiction-specific regulations. For example, an EMI in the EU must comply with the 5th Anti-Money Laundering Directive (5AMLD), while a CASP must meet MiCA’s enhanced disclosure obligations.

3. High Costs

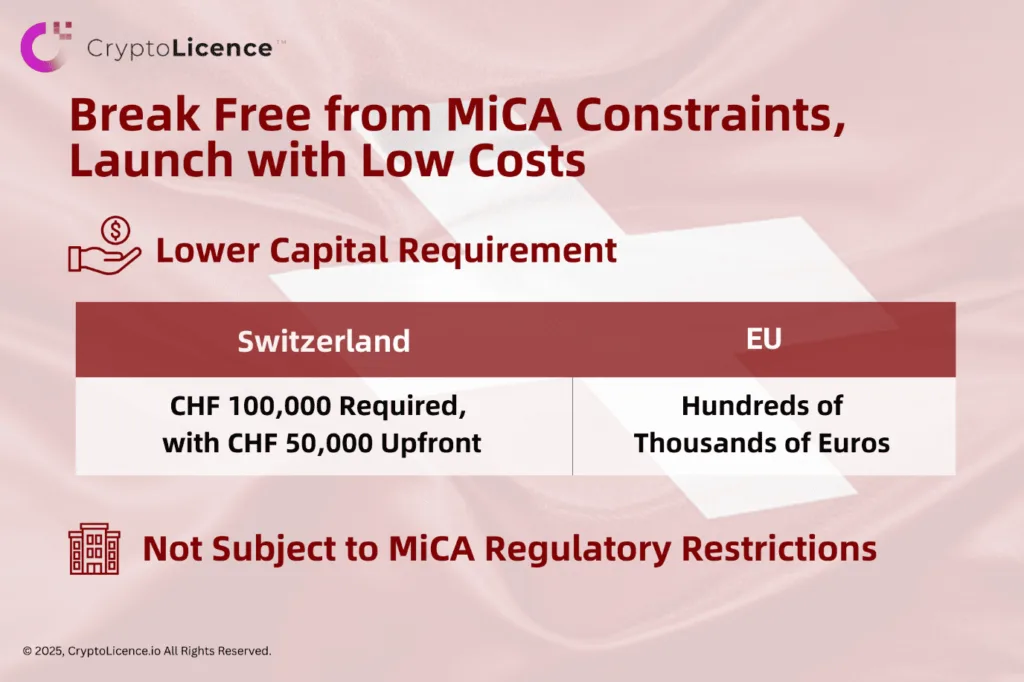

- EMI License: Minimum capital requirement of €350,000; legal and compliance costs of €200,000 – €500,000. Total setup: €550,000 – €850,000.

- CASP License (under MiCA): €100,000 – €300,000 in licensing and setup expenses.

- Combined Initial Investment: €2 – €5 million when factoring in compliance systems, company setup, and professional support.

- Ongoing Compliance: €500,000 – €2 million per year for staffing, audits, and regulatory reporting.

For most startups and SMEs, this level of investment is difficult to justify and often out of reach.

A New Path to Efficient Compliance: Exploring the 'One License, Dual Use' Model

This model allows companies to operate both fiat and crypto businesses under a single regulatory framework—bypassing lengthy licensing processes and significantly reducing costs. Two leading examples are Canada’s MSB license and Switzerland’s SRO membership.

Key Advantages

1. Rapid Market Entry

- Canada MSB: Registration-based, typically completed in 3 – 4 months. Enables fiat remittance, foreign exchange, and crypto services such as trading and custody.

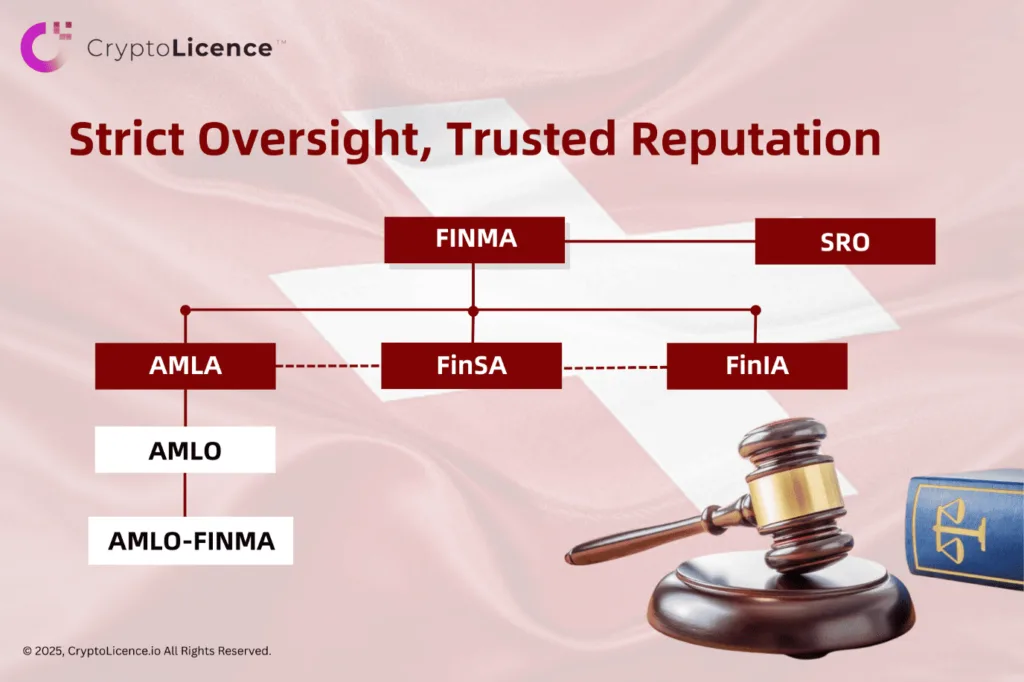

- Switzerland SRO: Approval through a self-regulatory organization (SRO) under FINMA’s indirect supervision takes about 5 – 6 months—much faster than EMI or CASP licensing.

2. Unified Compliance Framework

- Canada MSB: FINTRAC provides a unified AML/KYC guideline covering both fiat and crypto activities. Businesses need only one compliance officer and one compliance system.

- Switzerland SRO: SROs apply a single KYC/AML policy framework for fiat payments and crypto services. This model is ideal for innovative business models like STO and DeFi.

3. Significant Cost Savings

- Canada MSB: No minimum capital requirement. Legal and compliance support typically costs CAD 10,000 – 50,000. Annual maintenance: CAD 50,000 – 100,000.

- Switzerland SRO: Joining a recognized SRO like VQF costs CHF 10,000 – 30,000. Compliance support ranges from CHF 50,000 – 200,000. Annual audits and operational costs are CHF 100,000 – 500,000— significantly lower than the dual-license approach

With this model, startups and SMEs can reduce compliance costs by 50%–80% and launch operations within just a few months.

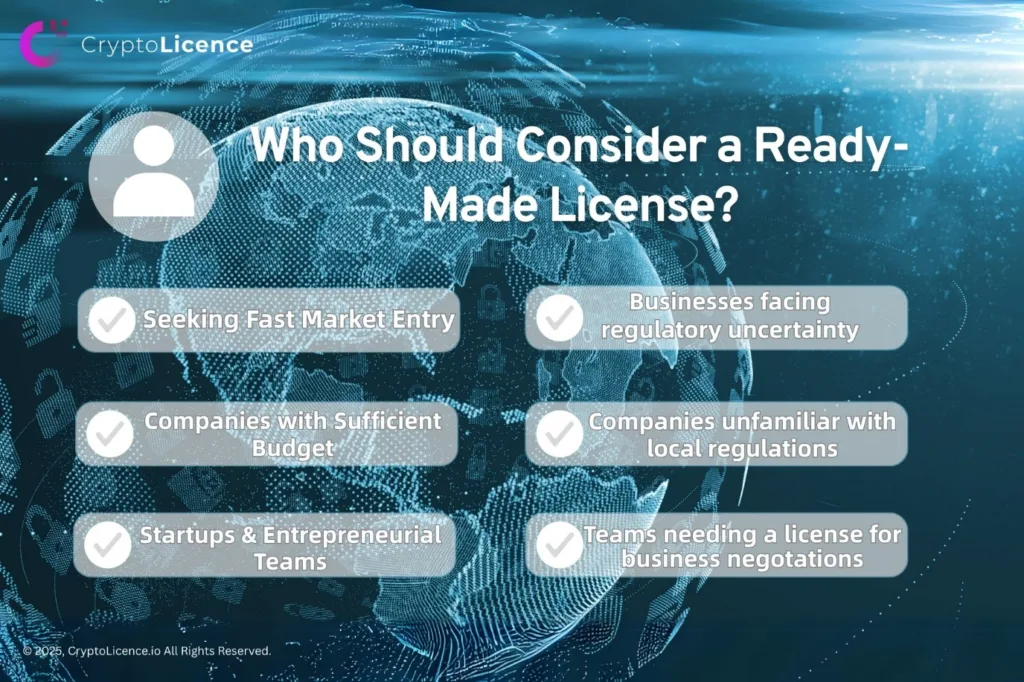

Who Should Choose “One License, Dual Use”?

While “dual licensing” may suit large enterprises with long-term global strategies, the “one license, dual use” model is clearly more efficient for teams with limited budgets and a need to launch quickly.

CryptoLicence: Your Smart Compliance Partner

At CryptoLicence, we specialize in helping you launch fiat and crypto services legally, efficiently, and cost-effectively:

✔ End-to-End Compliance Support

- Canada MSB: We manage the entire FINTRAC registration, assist with bank account setup, and can even support MSB acquisition to fast-track market entry.

- Switzerland SRO: From forming a GmbH or AG to customizing compliance frameworks and managing communication with FINMA and SROs like VQF, we handle the full process to maximize approval success.

✔ One-Stop Application Services

We provide comprehensive support across all stages: company incorporation, legal advice, AML/KYC policy creation, document review, audit coordination, and more. We also introduce crypto-friendly banks, EMI providers, and payment solutions to help build your infrastructure fast.

✔ Ongoing Compliance Management

Once your MSB or SRO status is secured, we continue to support your operations—covering audits, reporting, and regulatory updates to ensure you remain fully compliant.

Looking to launch your fiat and crypto business in just 1 – 6 months? Contact CryptoLicence today and start your journey toward faster, smarter compliance!