Unveiling the 5 Key Advantages of the Canada MSB License: The Top Compliance Choice for Startups

Table of Contents

The Canada Money Services Business (MSB) license is a strategic key for startups and small fintech firms aiming to enter the global market. Strictly regulated by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), the MSB license covers currency exchange, international remittance, payment solutions, and virtual currency services, opening vast opportunities for innovative enterprises. Thanks to Canada’s stable economy and open fintech policies, the MSB license offers a low-barrier, high-efficiency compliance path—helping startups stand out on the global stage. This article reveals the five core advantages of the Canada MSB license and how it can accelerate your global fintech expansion.

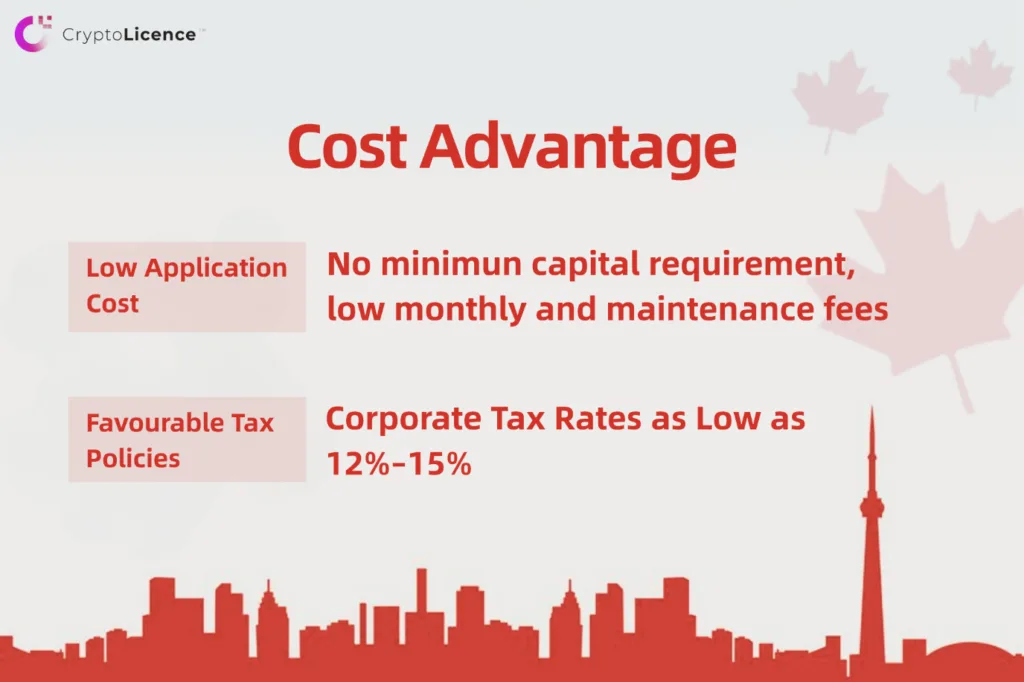

Cost Advantage of the Canada MSB License

Application and operational costs are often the biggest challenges faced by startups and small fintech companies. In this regard, the Canada MSB license offers significant advantages over financial licenses in the United States and the European Union. Its lower application fees, compliance costs, maintenance expenses, and tax benefits make it a highly competitive option for businesses aiming to expand globally.

1. Lower Application and Operational Costs

Unlike the complex and costly U.S. Money Transmitter Licenses (MTL) or EU Electronic Money Institution (EMI) licenses, the Canadian MSB license requires no large registration fees or capital requirements. For example: U.S. MTLs must be applied for state-by-state, each costing USD 1,000–5,000 with surety bonds from USD 50,000 to 1,000,000. EU EMI licenses cost ~EUR 5,000 to apply but require EUR 350,000+ in minimum capital. In contrast, the Canadian MSB license has lower application costs, no minimum capital requirements, and low monthly and maintenance fees. It is ideal for startups focused on growth.2. Favourable Tax Policiesdocumentation

The tax environment for Canadian MSB license holders further enhances its overall cost advantage. In Canada, the general corporate tax rate is 38%, but after federal tax deductions, it is reduced to 28%, and after general tax reductions, the net federal rate can be as low as 15%. On top of this, provincial tax rates apply. For example, British Columbia (BC), a popular province for business registration, offers additional tax benefits. For example:

- For Canadian-Controlled Private Corporations (CCPC), the first CAD 500,000 of eligible taxable income is taxed at a 2% provincial rate (small business rate).

- Income exceeding this threshold is taxed at a 12% provincial rate (general rate).

As a result, eligible small businesses can benefit from a combined tax rate of 17% (15% federal + 2% provincial), making it one of the most competitive tax rates in North America.

Other tax highlights include:

- A 25% dividend tax, typically reduced under tax treaties.

- A 5% Goods and Services Tax (GST), similar to VAT, which is exempt for certain financial services, including those involving virtual payment instruments.

By contrast:

- U.S. corporate taxes typically range from 21% to 27% (federal plus state), with complex interstate variations.

- EU VAT rates are usually around 20%, with higher regulatory and compliance costs.

With its lower tax rates and available exemptions, the Canadian MSB license provides startups with significant financial flexibility and cost efficiency.

Speed Advantage of the Canada MSB License

In the highly competitive fintech market, speed to market is crucial for startups and small fintech firms to gain a first-mover advantage. The Canada MSB license, regulated by FINTRAC, features a streamlined and transparent application process.

Businesses simply need to complete FINTRAC’s online pre-registration form and submit essential information, such as company registration documents, details of beneficial owners, and projected transaction volumes. If all documents are in order, the entire process—from company formation to license approval—can be completed within just 3 to 4 months.

This efficient application timeline provides an ideal path for global fintech companies to achieve fast-track compliance and swiftly capture market opportunities. For small enterprises, it offers a direct route from concept to market, enabling them to keep pace with evolving fintech trends.

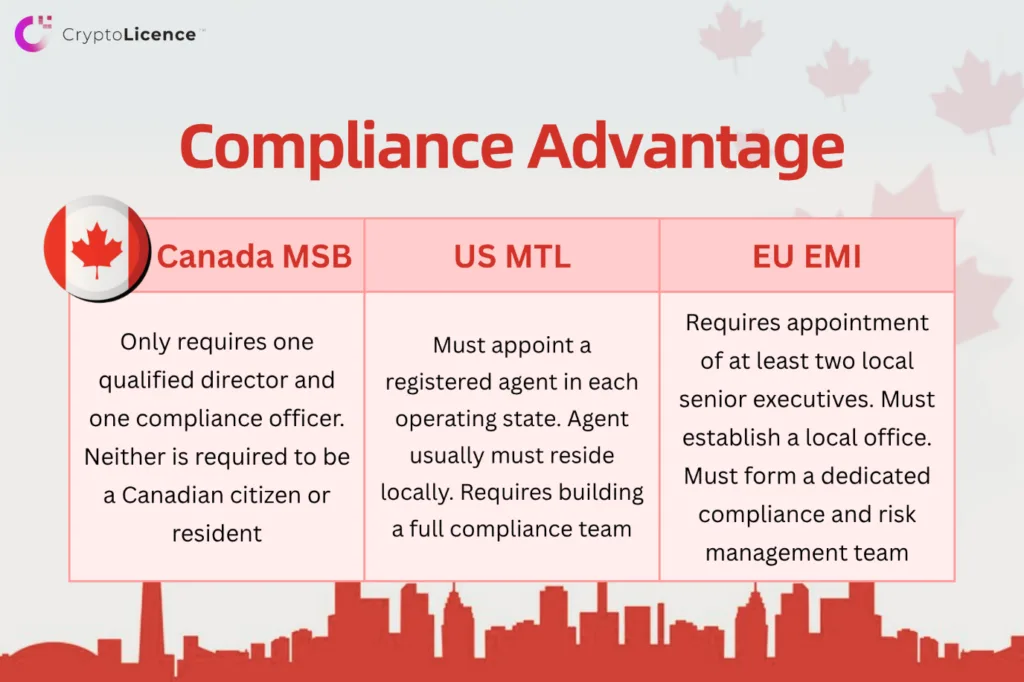

Compliance Advantage of the Canada MSB License

For small and medium-sized enterprises, complex compliance requirements are often a major barrier to entering the financial services industry. The Canada MSB license offers a highly efficient compliance pathway with its simple application criteria and low maintenance costs.

The compliance framework for the MSB license is clear and straightforward, particularly regarding personnel requirements:

- Only one qualified director and one compliance officer are required.

- Neither needs to be a Canadian citizen or resident.

- The compliance officer must simply have a solid understanding of Canadian AML and KYC regulations and be familiar with FINTRAC’s requirements.

In comparison, the U.S. MTL license requires appointing a registered agent in each operating state (usually a local resident), along with building a full compliance team—significantly increasing cost and complexity. The EU EMI license mandates establishing a physical office in the EU, appointing at least two local senior executives, and forming dedicated compliance and risk management teams—setting a much higher threshold than the Canadian MSB.

Additional requirements for obtaining a Canada MSB license include:

- Registering a company (corporation or LLC) in Canada, with a local business address and registered agent to receive official correspondence.

- While opening a bank account is not required for registration, a commercial bank account is needed if conducting MSB business within Canada.

- Preparing and implementing AML and KYC policies in accordance with Canadian law.

- Submitting a detailed business plan outlining the scope of MSB services and activities in Canada.

- Filing suspicious transaction reports (STRs) with FINTRAC for any activity potentially linked to money laundering or terrorist financing.

- Renewing MSB registration every two years to maintain compliance.

This lightweight compliance structure allows small businesses to meet FINTRAC’s regulatory expectations with minimal resource input—freeing them to focus on innovation and growth rather than regulatory burdens.

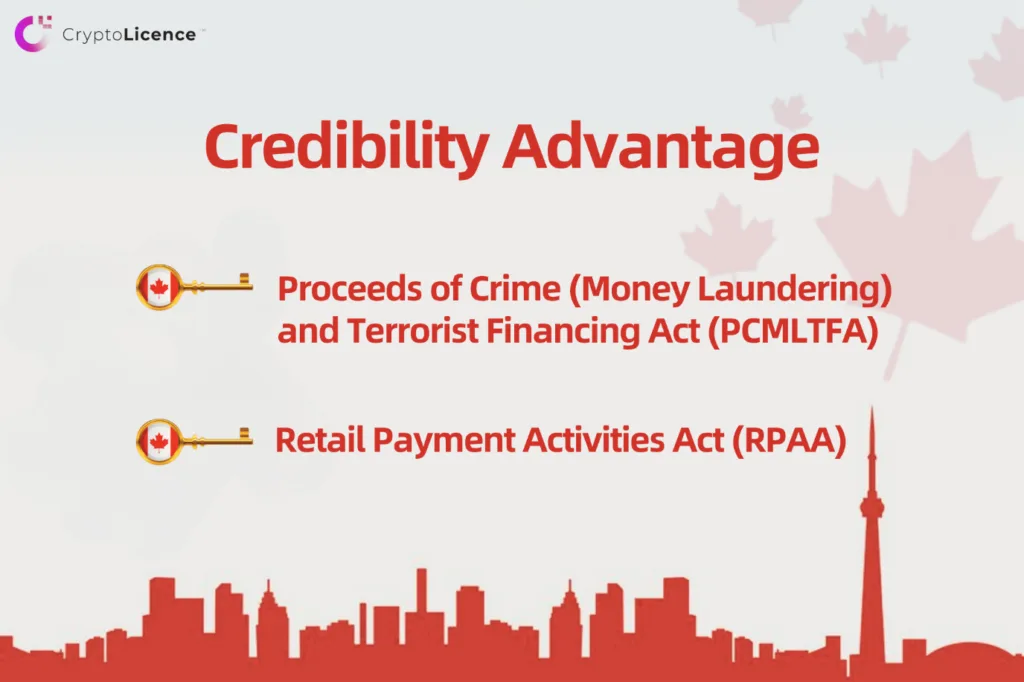

Credibility Advantage of the Canada MSB License

The Canada MSB license is strictly regulated by FINTRAC, providing startups and small fintech companies with a strong stamp of credibility that boosts trust among global investors and clients.

MSB businesses are required to comply with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). FINTRAC enforces strict penalties for non-compliance to ensure that MSBs maintain high operational standards and uphold market reputation.

Key penalties under the PCMLTFA include:

| Penalty Type | Amount / Consequences |

|---|---|

| Administrative Monetary Penalties (AMP) | CAD 1,000 – 100,000 per violation for individuals; up to CAD 500,000 per violation for entities |

| Criminal Penalties | Willful violations may lead to significant fines and imprisonment |

| Deregistration | Serious non-compliance can result in the revocation of the MSB registration |

Furthermore, starting November 2024, under the Retail Payment Activities Act (RPAA), all MSBs must register with the Bank of Canada. Failure to complete this registration by November 15, 2024 may result in penalties starting at CAD 1,000,000 and potential suspension of business activities. This added layer of oversight strengthens consumer fund protection and enhances the integrity of Canada’s payment ecosystem.

This credibility advantage helps Canadian MSB license holders gain greater acceptance in sectors like currency exchange, cross-border remittances, and crypto-related financial services—positioning them for long-term success in the global market.

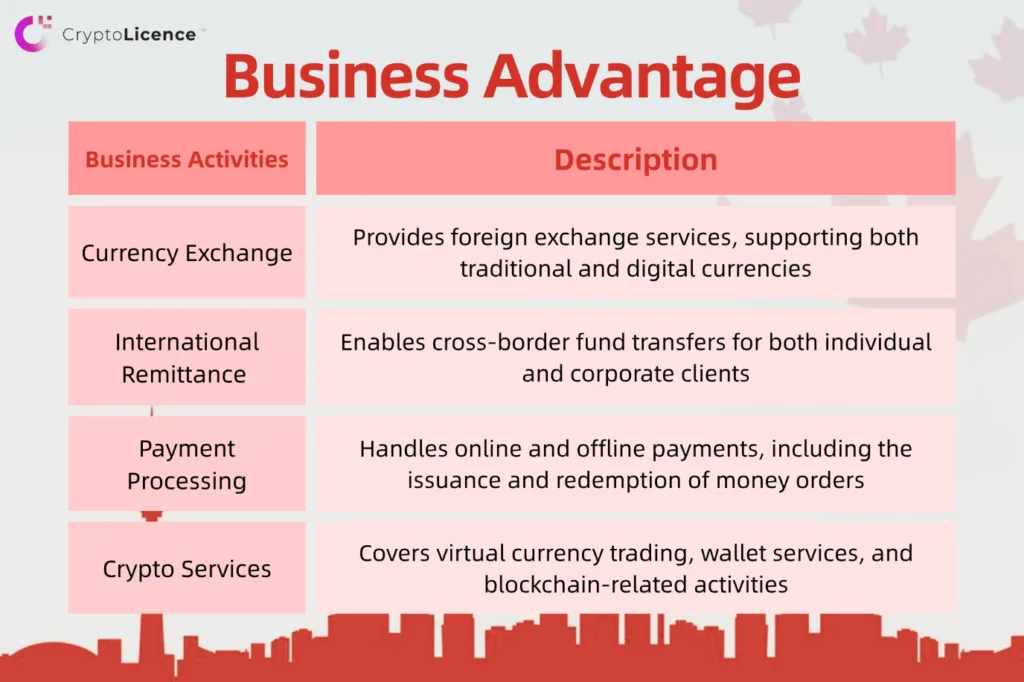

Business Advantage of the Canada MSB License

The Canada MSB license supports a wide range of financial service activities, making it particularly suitable for startups aiming to diversify within the fintech space. Whether your business focuses on cross-border remittances, digital payment solutions, or cryptocurrency exchange services, the MSB license provides a legal and compliant operating framework.

Supported business activities include, but are not limited to:

This broad scope of permitted activities enables startups to adapt their service models flexibly based on market demand, test and iterate new offerings at relatively low operating cost, and evolve from traditional money services into full-fledged crypto and digital finance platforms.

CryptoLicence Helps You Obtain a Canada MSB License

Ready to scale your fintech business in Canada? CryptoLicence offers an end-to-end solution to help you efficiently obtain your MSB license and fast-track your international expansion. Our comprehensive services include:

- Providing a local Canadian office address and phone number, along with registered mail handling for compliance purposes

- Assisting with registration under the Retail Payment Activities Act (RPAA) with the Bank of Canada to meet the November 15, 2024 deadline

- Guiding you through the process of opening a commercial bank account in Canada, including introductions to crypto-friendly banking partners

- Managing the complete FINTRAC MSB registration process, including drafting AML/KYC policies in full compliance with Canadian regulations

- Delivering legal advisory, documentation support, audit preparation, and ongoing compliance services to ensure your business launches smoothly and stays fully compliant

Whether you’re setting up a new operation or acquiring an existing MSB entity, CryptoLicence is your trusted partner. Contact CryptoLicence today and take your fintech venture to the next level!