Pain Points in the Crypto Market: How to Overcome Bank-Account Bottlenecks and Card-Issuance Hurdles?

Table of Contents

The rapid growth of blockchain technology and cryptocurrencies is reshaping global finance. Yet in today’s tighter regulatory climate, securing a licence is only the first step toward lawful operation. For virtual-asset service providers (VASPs), a licence alone does not guarantee business readiness: opening bank accounts, integrating payment rails, issuing crypto cards, and stress-testing systems remain thorny milestones. Multi-currency or “crypto-friendly” business accounts are routinely declined, card-issuance projects stall on compliance grounds… and market-entry windows close. If you are wrestling with those roadblocks, read on. This article unpacks the banking and card-issuance challenges that VASPs face before launch—and shows how CryptoLicence leverages global resources and expert support to steer you through.

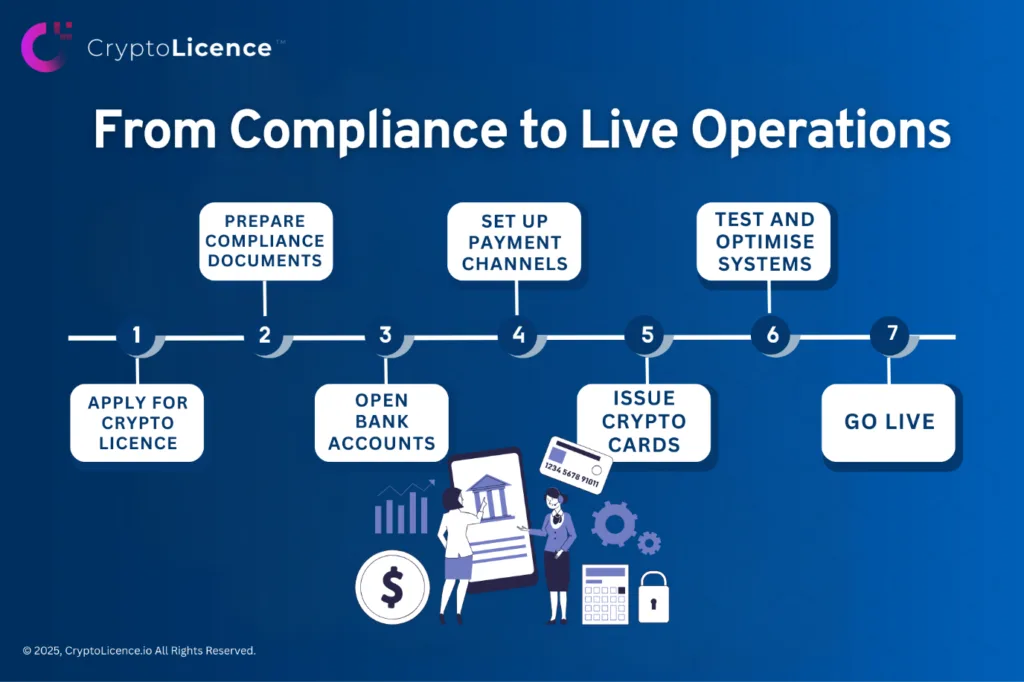

Seven Key Steps from Compliance to Live Operations

Turning regulatory approval into competitive advantage requires clearing a chain of critical stages. Below is a streamlined roadmap from licence application to go-live, highlighting each phase’s main task set.

1. Apply for a crypto-asset licence

Submit to the relevant authority (e.g., Dubai VARA, Switzerland’s FINMA), meet AML/CTF and other requirements, and obtain VASP or SRO status.

2. Prepare compliance documentation

Draft AML/KYC frameworks, file a detailed business plan, prove source of funds, and present risk-management measures for regulatory review.

3. Open bank accounts

Secure multi-currency accounts (USD, EUR, GBP, etc.) for treasury, settlement, and client funds.

4. Set up payment channels

Connect to Visa, Mastercard, or crypto on/off-ramp providers via APIs for seamless fiat–crypto transactions.

5. Issue crypto cards

Partner with a card issuer (e.g., a Visa principal member) to launch debit or prepaid cards that spend crypto balances effortlessly.

6. Test and optimise systems

Rigorously test account, payment-gateway, and card platforms for security, stability, and zero-fault performance.

7. Go live

Roll out exchange, custody, or payment services, refine user experience, and capture market share.

Why Is Opening a Bank Account So Hard?

Once a licence is in hand, banking is the linchpin of actual operations. Yet the very nature of crypto firms triggers multiple layers of resistance.

1. Banks’ Cautious Stance toward Crypto

Current situation: Because crypto businesses involve pseudonymous transactions, high price volatility, and potential money-laundering risks, banks classify them as high-risk. Global watchdogs such as the FATF require banks to apply enhanced due-diligence (EDD) procedures to VASPs.

Pain point: Many large traditional banks take an even more cautious stance—either refusing outright to open accounts for VASPs or demanding an extensive compliance file that includes detailed fund-flow proof, full customer-identity records, and comprehensive operating reports.

Impact: Companies may compile hundreds of pages of documentation over several months, yet still face rejection, limiting their cash-management options and stalling business growth.

2. High Compliance Barriers

Current situation: Banks must observe strict international AML and CFT rules as well as local regulations. They expect crypto firms to prove that their funds are legitimate, their business model is transparent, and their risk-management programme is comprehensive.

Pain point: Many start-ups and SMEs lack a dedicated compliance team and therefore struggle with the complex paperwork and multiple review cycles that banks demand. Preparing the file is costly and time-consuming.

Impact: Account applications are rejected for incomplete or non-conforming documents—or drift into indefinite postponement—directly choking cash flow and stalling market expansion.

3. Restrictions on Multi-Currency Accounts

Current situation: VASPs typically need multi-currency accounts that can hold USD, EUR, JPY, CHF, AUD, HKD, and more—both to hedge FX risk and to receive or pay in a client’s native currency.

Pain point: Standard multi-currency accounts rarely permit crypto activity. Fiat-to-crypto (on-ramp) and crypto-to-fiat (off-ramp) flows require extra compliance clearance, causing many banks to refuse these accounts. Virtual sub-accounts—multiple currency-enabled wallets under one master account—are even harder for crypto firms to secure because banks worry about fund-tracing complexity.

Impact: Without multi-currency accounts, crypto businesses cannot satisfy diverse global payment preferences, limiting flexibility and eroding competitive edge.

Card-Issuance Challenges: Balancing Risk, Compliance, and Marketing

Issuing crypto cards is a pivotal strategy for VASPs to boost user experience and broaden market reach, yet the road is rocky—from the card schemes’ strict vetting and high technical-compliance bar to the practical hurdles of rolling out effective marketing campaigns.

1. Risk Assessment by Card-Issuing Networks

Current situation: Visa, Mastercard, and their issuers are wary of opaque fund sources and illicit-trade exposure; strict AML/CTF rules apply.

Pain point: A crypto card must bridge blockchain wallets and legacy networks, raising compliance complexity. Issuer due-diligence cycles span 2–3 months; direct scheme approvals can stretch to 6–12 months or more.

Impact: High risk thresholds delay or derail projects; many firms abandon card plans altogether.

2. Technical & Compliance Requirements

Current situation: A crypto-card programme must satisfy the card scheme’s compliance standards—PCI-DSS, KYC/AML, EMV chip specifications—and integrate a payment engine that converts crypto to fiat in real time.

Pain point: Most start-ups and SMEs lack the resources to build secure blockchain-payment APIs or pass PCI-DSS audits; limited technical bandwidth drives up integration costs and stretches timelines.

Impact: The twin hurdles of technology and compliance slow card-launch projects; while white-label solutions cut code complexity, the stringent regulatory layer still causes many firms to hold back.

3. Marketing Execution for Crypto Cards

Current situation: Crypto cards attract users through friction-free spending, brand visibility, and wider market reach. In an increasingly competitive space, however, success hinges on finely targeted campaigns aimed at specific segments—for example, crypto investors or blockchain enthusiasts.

Pain point: Crafting incentives that genuinely resonate—crypto-cashback, trading-fee discounts, and similar perks—must balance technical feasibility with implementation effort. Building an on-chain loyalty programme or integrating wallet apps requires significant investment, so costs and expected impact must be carefully weighed to keep ROI positive.

Impact: Without a professional, data-driven marketing strategy, user engagement remains low, market share for the crypto card stays limited, and marketing spend delivers less-than-expected returns.

CryptoLicence—Your Gateway Partner to the Crypto Economy

Leveraging a worldwide network and deep professional expertise, CryptoLicence helps you quickly establish bank accounts and payment rails that work seamlessly with crypto operations. We match you with the most suitable banks and card-payment solutions, turning regulatory compliance into a real competitive edge.

Our team has in-depth knowledge of key markets—Hong Kong, Singapore, Malaysia, Europe, and North America—and delivers bespoke compliance strategies for businesses everywhere. We also help you obtain multi-currency accounts efficiently, so you can receive customer funds, remit to foreign-currency accounts, pay overseas staff, and more.

If you plan to launch a crypto card, CryptoLicence offers two Visa-authorised programmes:

- MPI licence holders: USDT top-ups, settled in HKD

- MSO licence holders: USDT and USDC top-ups, settled in SGD

- USD-denominated cards: available case-by-case, subject to issuing-bank approval

Card Fee Schedule:

| Types | MPI licence holder (Visa Principal) | MSO licence holder (Visa Principal) |

|---|---|---|

| Authorised Network | VISA | VISA |

| Set-up Fee | USD 20,000 | USD 18,000 |

| Monthly Fee | USD 1,000 | From USD 7,000 |

| Physical Card Cost | USD 10 per card | USD 6 per card (minimum order 1,000) |

All fees are indicative only and may be adjusted by the issuing bank or in response to regulatory requirements.

Companies should choose the card-issuance programme that best fits their target customers and market strategy to achieve maximum impact, and CryptoLicence can supply the in-depth expertise you need. Contact CryptoLicence today for a free consultation and unlock a one-stop solution that propels your crypto venture to the front of the market!

This article is for industry reference only and does not constitute legal or investment advice. For tailored compliance plans, please consult a qualified professional.